Cyclone Metals Ltd (ASX:CLE) has delivered a massive increase to the mineral resource estimate at its Iron Bear Project in the Labrador Trough of Labrador, Canada, upgrading it from 7.2 billion tonnes to 16.6 billion tonnes of iron (Fe) grading 29% total Fe and 18,2% magnetic Fe (at a cut-off grade of 12.5% magnetic Fe).

The upgraded mineral resource is compliant with the JORC code and includes 2.15 billion tonnes at the indicated status and 14.5 billion tonnes at the inferred status. In addition, the company has defined an exploration target of between 16 and 21 billion tonnes at a grade of 24% to 33% iron and 16% to 22% magnetic iron.

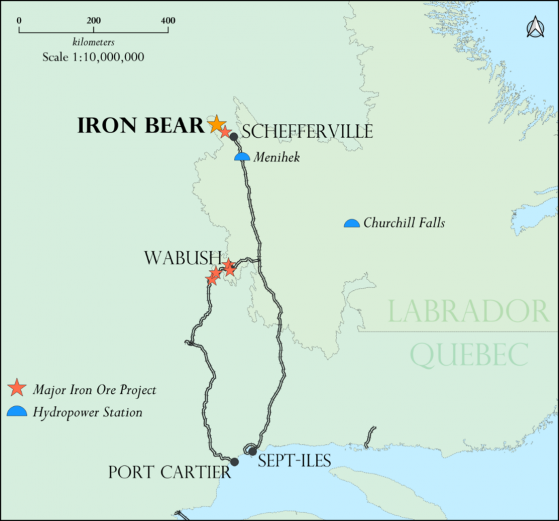

According to Cyclone Metals, this is the largest undeveloped iron ore deposit in the world located in close proximity to open access heavy haul rail and power.

Location map of the Iron Bear Project.

Cylcone Metals achieved this JORC-compliant upgrade by completing extensive geophysical analysis and demonstrating an excellent correlation between a newly developed magnetic inversion model based on a high definition aerial magnetic survey and the existing drilling data.

Potential for economic extraction

Cyclone Metals says its analysis of the Iron Bear ore body’s characteristics indicate it has good prospects for eventual economic extraction based on the favourable characteristic of the ore body, its location near infrastructure and the excellent metallurgical test results which delivered some of the best quality magnetic concentrates available on the market today with high production yields (referred to as Direct Reduction grade magnetic concentrates).

According to Cyclone Metals these Direct Reduction concentrates are critical for low carbon steel production and achieve very high premiums on the seaborne iron ore market compared to benchmark 62% Fe iron ore products.

Metallurgical test work conducted at the company’s pilot plant in Quebec City supports this conclusion, having achieved:

- production of a Direct Reduction grade concentrate grading 70.6% iron and 1.2% silica with an overall magnetic iron yield of 88.9%;

- production of a Blast Furnace grade concentrate grading 68.9% iron and 3.4% silica with a magnetic iron yield of 95.5%; and

- very low deleterious elements (phosphorus, manganese oxide etc).

The ore body has a very low stripping ratio (

Economic and technical studies are ongoing and expected to deliver potential production scenarios in the next couple of weeks. In addition, Cyclone Metals is planning to provide bulk samples of Direct Reduction concentrates and pellets to potential steel customers by end of Q2 2024 with a view to start setting up supply agreements.