Bitcoin (BTC) bulls are back in the driving seat after a period of sell-side dominance.

The benchmark cryptocurrency added 4% against the US dollar yesterday after a solid weekend trading session, with further gains this morning.

At the time of writing, the BTC/USD pair was swapping for $71,000.

Though still a few thousand dollars below the all-time high two weeks ago, it’s a step up from bitcoin’s post-ATH plummet to the low-60k range.

There’s a good reason for bitcoin’s recent recovery- as shown by Farside Investors’ tracker, bitcoin exchange-traded funds broke their five-day outflow streak to add $15.4 million yesterday.

These ETFs, which were approved in January, have been a major source of bitcoin bullishness in 2024, so a return to form has galvanised the buy-side market.

Year-to-date inflows across the whole bitcoin ETH market are currently around $11.3 billion.

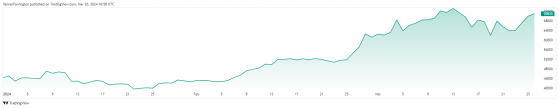

Bitcoin is up 68% year to date – Source: tradingview.com

Ethereum (ETH), the world’s second-largest cryptocurrency, has matched bitcoin’s week-on-week performance by adding 12% to $3,649.

Altcoins in general have rebounded, with BNB, Solana (SOL), Dogecoin (DOGE), Ripple (XRP) and the rest of the blue chips penning double-digit gains.

Global cryptocurrency market capitalisation currently stands at $2.69 trillion, with bitcoin dominance at 52%.

Read more on Proactive Investors AU