Creso Pharma Ltd (ASX:CPH, OTCQB:COPHF) has secured commitments to raise a total of up to $7.6 million through the issue of two separate convertible notes.

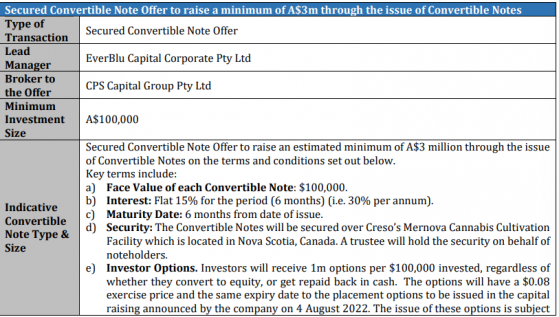

The new funding includes commitments from new and existing professional investors to raise $2.6 million through the issue of secured convertible notes.

It also includes an additional agreement with NY-based asset and fund manager Obsidian Global GP, LLC to raise $5 million via convertible notes.

Notably, the funds will be deployed to support marketing and sales of the company’s existing products in Canada, Europe, and the US, further advancement of Halucenex’s Phase II clinical trial, review and completion of potential M&A opportunities, and general working capital.

Well positioned to deliver shareholder value

Creso CEO and managing director William Lay said: “We are very pleased to have secured additional funding from new and existing investors and I would like to take this opportunity to thank them for their ongoing support.

“We are also pleased to have commenced this relationship with Obsidian.

“Obsidian has a successful track record of supporting ASX-listed growth companies and we believe that the financing provided by both convertible notes will allow us to continue progressing various opportunities being presented in the current macroeconomic environment.

“Creso remains well positioned to deliver shareholder value via ongoing penetration into the various, high growth, plant-based verticals that it currently resides in and we look forward to providing additional updates to our shareholders as these opportunities crystallise.”

Fundraising summary

EverBlu Capital Corporate Pty Ltd acted as lead manager on both convertible note raisings.

Mr Blumenthal, former director of Creso Pharma Limited and a related party, has confirmed his commitment to participate in the secured convertible note offer for $500,000 of the $2.6 million secured convertible notes committed.

Looking ahead, Creso intends to convene a meeting of shareholders to seek approval for the conversion of the secured convertible notes into shares and options at a meeting in January 2023.

Read more on Proactive Investors AU