The October 2023 CreditorWatch Business Risk Index (BRI) has revealed a notable decrease in Australian business activity. The average value of invoices is now at its lowest since January 2015, indicating a 34% year-on-year decline. This reduction in invoice values is primarily attributed to a decrease in consumer demand, affecting forward orders and impacting the supply chain.

Data Sources: CreditorWatch trade receivables data (accounting software integration).

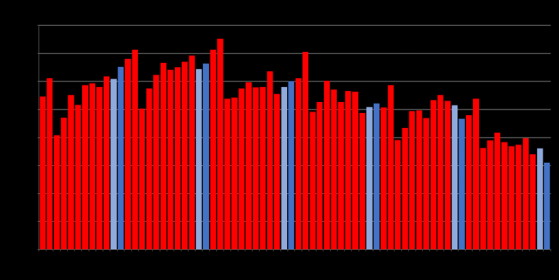

B2B trade payment defaults, a key indicator of business activity tracked by CreditorWatch, have been increasing, although there was a slight reduction from September to October. These defaults are still higher than the levels seen before the COVID-19 pandemic, suggesting an increased likelihood of business failures.

Data source: CreditorWatch Trade Payment default data (lodged defaults).

External administrations have risen, showing an 81% year-on-year increase, exceeding pre-COVID figures. Meanwhile, there has been a decline in credit enquiries on the CreditorWatch platform since May, reflecting a general decrease in business activities and a reduced number of commercial loan applications.

CreditorWatch forecasts a potential increase in business failure rates to 5.78% over the next year, up from the current rate of 4.21%.

Activity by region

The report also compares capital city CBDs, noting Melbourne City as the most improved area, with a six-point rise on the business risk index to 32.8. On the other hand, Sydney Inner City has seen a decline, dropping 4.8 points to 24.1.

Melbourne's improvement is partly due to increased foot traffic, particularly during non-working hours, including weekends and nights. The city has benefitted from a variety of activities, including the influx of international students and the return of sporting events.

Regions like Western Sydney and South-East Queensland are identified as higher-risk areas, sensitive to interest rate changes and characterized by high debt levels and lower incomes. In contrast, the best-performing regions, such as regional Victoria, inner-city Adelaide, and North Queensland, are characterized by more affordable property and rent prices, alongside higher average incomes.

“Cost-of-living pressures bite”

CreditorWatch CEO, Patrick Coghlan, says the RBA’s attempts to curb inflation with interest rate increases is hitting businesses hard as consumers curtail spending.

“Consumer demand is one of the key drivers of the economy and that is coming to a grinding halt as cost-of-living pressures bite,” he says. “Costs of rents, electricity and fuel are all still very high despite the RBA’s best attempts to drive down inflation. Mortgage holders are suffering from increased loan repayments as well.

“Two of our leading indicators, average value of invoices and B2B payment defaults, paint a very clear picture of what businesses are going through at the moment: order values are dropping, therefore so are revenues, and margins are also being squeezed through inflation.

“That is causing an increase in the number of businesses that are unable to pay their invoices to suppliers – and that is a real worry because those defaults greatly increase the chance that a business will not survive into the future. All the data is pointing to another challenging Christmas trading period so it is prudent for businesses to follow up on outstanding debts before then.”

Read more on Proactive Investors AU