With battery minerals on the rise, Corazon Mining Ltd (ASX:CZN) is buoyed by further lithium upside at its Miriam Nickel Project in WA’s Eastern Goldfields.

A recent soil sampling program — focused on an emerging spodumene-bearing pegmatite discovery that returned up to 1.85% lithium oxide — has expanded the lithium target to roughly 1.6 kilometres long and 300 metres wide.

Soil assays from Miriam’s growing lithium footprint returned up to 99 parts per million (ppm) lithium, while results close to the spodumene-rich outcrop returned between 22.1 and 76.4 ppm.

Corazon plans to conduct a shallow drilling program to test the lithium anomalism, working in tandem with an aggressive exploration program at the Miriam nickel sulphide trend to the west.

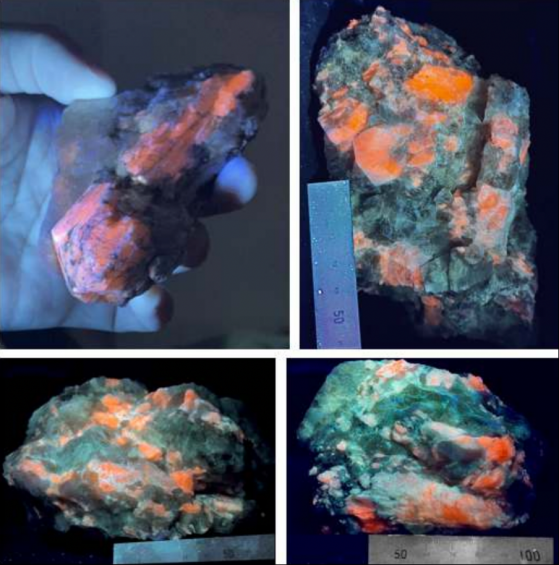

UV light showcases the spodumene-rich pegmatite in orange.

Soil survey says …

Interestingly, the lithium outcrop at Miriam represents a small pegmatite exposure within an old gold prospecting trench. However, thin soil cover makes it hard to effectively assess the size and extent of this pegmatite intrusion.

As such, a soil sampling program was chosen to better define the spodumene-rich pegmatite for drilling.

Corazon’s team collected 636 soil samples on a 100-metre by 40-metre grid surrounding the outcropping pegmatite, as well as other areas of interest that showed pegmatitic float material.

The results point to a well-defined lithium anomaly, generating a spodumene-rich target for the initial round of drilling.

Geochemical findings also defined a second trend in the targeting zone’s central north, where pegmatitic float trends east-northeast and intersects with the northern part of the main anomaly.

Miriam Project 'lithium in soils’ image over aerial photograph.

What now?

With two battery commodities in the crosshairs at Miriam, Corazon is incentivised to progress a dual-pronged exploration strategy.

The hunt for nickel sulphides and lithium pegmatites will continue via the drill rig, with plans to secure requisite approvals for reverse circulation, diamond and core campaigns.

Overall, Corazon sees Miriam as a valuable second-tier project for its cornerstone Lynn Lake Nickel-Copper-Cobalt Project in Manitoba, Canada.

The ASX-lister plans to update the market on activity at Lynn Lake in the next few weeks.

Read more on Proactive Investors AU