Is copper set for a rally? The fundamentals remain strong, despite the price moving sideways recently in light of rising interest rates, inflation, COVID uncertainty in China, the US dollar and the war in Ukraine.

In this article:

- The overview

- A shortfall is coming

- China's great wall of copper

- What does this mean for price

- More production is required

- Are small caps the solution?

- The final word

The volatility caused by those events has seen all commodity prices fluctuate.

Copper, which is a key indicator of economic health, began the year trading at US$9,720.50 per metric ton. It hit an all-time high of US$10,674 and spent months trading at 20-year highs.

Currently it is hovering around US$7,500.

Despite the drop, copper has generally held its ground. The metal traded in a tight range throughout October and just above the late September low.

However, in a sign of what may come on November 3, we saw prices rally over 5% as the US dollar index began to slide. An inverse relationship between commodity and dollar generally drives one up and the other down. The dollar is the benchmark pricing mechanism for most commodities.

Here’s an explainer:

Bullish momentum could continue in light of a weakening dollar. Momentum may also gain pace as China prepares to ease its zero-COVID policies and a shortfall/supply gap develops, which will increase demand.

“A copper shortfall is being driven by a multitude of economic and political pressures which will, in our view, support strong long-term demand,” Celsius Resources executive director Peter Hume said.

“The electrification of the global vehicle fleet and a switch to renewable energy for power generation as the world transitions to greener energy will be a key driver.

“Significantly more copper is required in both vehicle batteries and renewable energy infrastructure such as solar panels and wind turbines.

“This is being further underpinned by accommodative government policies designed to enable the transition to meet decarbonisation objectives.

“We also believe a lack of exploration and investment in new copper mines in recent years has meant current output is incapable of supplying the forecasted leap in demand,” Hume said.

Let’s break these macro drivers down.

A shortfall is coming

More than 20 million tonnes of copper are consumed each year. The base metal is required for building construction, power generation/transmission, electronic product manufacturing and most recently electric vehicles and clean energy technologies.

These are trillion-dollar industries, all with trillions of dollars of new projects on the go or in the gun.

From blacktop infrastructure projects including roads and airports to renewable energy projects.

Copper is required for just about anything and everything.

There’s a problem though.

A report by S&P Global states, “Efforts to reach carbon neutrality by 2050 are likely to remain out of reach as copper supply fails to match demand amid the growing use of solar panels, electric vehicles and other renewable technologies.”

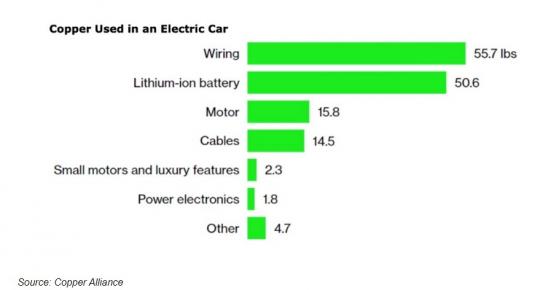

One simple fact highlights the growing need for copper: an average electric vehicle contains about four times as much copper as regular vehicles.

Renewable energy systems contain 12 times more copper than traditional energy systems. Wind farms use anywhere between 4 to 15 million pounds; solar photovoltaic farms require 9,000 pounds per megawatt.

A report by Ernst and Young suggests Europe will have 130 million EVs by 2025. Each takes about 85 kilograms of copper.

Add the copper required for charging stations and you have yourself a lot of copper that may not be available unless new sources are found.

An extra million tonnes is required over and above what is being currently produced.

And that’s not even putting China and its projects into the mix?

China’s great wall of copper

China is expected to ease its COVID zero policy by March next year. That will not only settle the market down a little bit, but will increase demand for commodities, especially copper.

Chinese officials are now concerned over the economic impact on the country of further lockdowns, which have already dampened demand and production of Chinese goods.

In this time, copper has remained stable, but should China open its doors again markets like copper will likely rebound.

Production will be untethered. Demand unleashed.

A key driver will be China’s property market and the construction sector, which will underpin growth across new energy sectors.

The Chinese government has committed US$1.4 trillion on copper-heavy infrastructure programs, including 5G networks, industrial internet, inter-city transportation and rail systems, ultra-high-voltage power transmission and EV charging stations for its

Made in China 2025 and China Standards 2035 initiatives.

“Consumption in power grids and new energy including EVs are offsetting losses from traditional sectors such as home appliances,” said Ji Xianfei, an analyst with Guotai Junan Futures Co.

Traditional use in pipes and wiring is still dominant, however the shift to renewables will add to China’s demand for the base metal.

According to Cru Group, China’s copper demand will rise about 0.8% this year to 15.55 million tonnes. There will be growth of more than 4% from autos and electricity transmission countering a 4% decline in construction and a 2% drop in consumer durables.

Cru Group predicts copper use in EVs will rise to 2.8% of the total versus last year’s 2.2%.

What does this mean for price?

By 2026, mean cash copper prices are expected to reach $9,750/ton, exceeding the relatively high $9,317/ton annual average established in 2021.

Most analysts agree that copper’s long-term outlook is bright, particularly in considering its role in the shift toward green energy and the investment opportunity this brings.

“Copper for us — and I’d say it should be for most investors — is a long-term theme, so we’re not chasing anything in haste, and at the same time, we're always looking for new stories,” Paola Rojas of Synergy Resource Capital told INN.

Rojas is bullish on copper’s use in energy transition.

“This part of the market is poised to grow exponentially, so much that I believe it will change it in ways we can’t even foresee yet. It is already a big market — the third metal market after iron and aluminium — and elephants move slowly, so this will be a challenge,” she said.

Rojas is also factoring in supply issues to the rising price.

“In this volatile environment we are keeping positions in our highest-conviction names, while adding selectively more producers, especially those with high dividend yields, such as BHP (ASX:BHP), Rio Tinto (ASX:RIO) and stellar juniors,” Rojas said of her firm’s investment strategy.

It’s not just the big end of town that will benefit.

“The increase in commodity price will have a positive impact on the cashflow of Celsius Resources projects,” Hume said.

“As an example, the current financial model of the MCB Project has allowed for 4.0 $/lb (~ $ 8,816/ton) for the copper price, hence, the increase of +10% (~ $ 9,750/tons) in the commodity price increases its NPV by an additional $100 million.

“This is supported by the sensitivity analysis done in the scoping study (see below).”

Looking at the future of copper prices, Hume said: “Reports suggest the world will be short 1.6 million tonnes of copper in 2035, with significant deficits beginning this decade.

“Whilst there is some conjecture over the short- and long-term price of copper, we agree with many leading analysts that a supply shortfall, based on available data, could occur within the next five years, which should support an increasing copper price.

“The world’s biggest copper trader, Trafigura Group, expects the metal to enter a range of $12,000 to $15,000 a ton over the coming decade as the green revolution takes hold.”

More production is required

Trafigura has warned that global copper stocks have fallen to record lows and current inventories would only be enough to supply world consumption for 4.9 days.

Freeport-McMoran has also warned of shortage risks, saying lower prices are not reflective of the tightness in the physical market.

All roads, built or otherwise, lead to higher copper prices. Which then leads to more spend on mine development.

“We believe significant mine supply response will be required to meet this new area of demand growth and a higher copper price will be needed to incentivise the new production into the market,” said Daniel Greenspan, senior analyst and resource team director at CIBC Asset Management.

Significant response is easier said than done. In the last 10 years, the world’s largest copper mines have battled declining copper grades and a lack of new copper discoveries.

S&P Global Market Intelligence analyst Kevin Murphy stated in 2020 that out of the 224 copper deposits discovered between 1990 and 2019, only 16 were discovered in the last decade.

Over the last few years that issue was exacerbated by a lack of spend brought on by COVID, which delayed or halted production altogether.

It can take more than 15 years to develop a newly discovered deposit into a producing mine – investment is required.

Chile and Peru represent 40% of global output, but the biggest miners in these countries such as BHP are now facing increased royalty payments as part of tax reform.

That’s fair enough, but miners are now nervous.

"Without any world-class projects on the horizon, the prospects for sustaining production are not good," said Gonzalo Tamayo, an analyst at Macroconsult and a former Peruvian mines and energy minister.

CRU Group expects the copper market to realise a structural deficit by the early 2030s unless there is additional mine investment.

“If there isn’t enough physical supply, then the price will need to rise to incentivise more mines to come online, and/or there will need to be demand destruction, with a switch to alternative materials or products simply not being manufactured, in the worst-case scenario,” analyst Robert Edwards said.

Are small caps the solution?

“While Celsius is only identified as a small emerging player in the overall copper picture, the mineral assets of the company are world-class. Within two years of taking on the Philippine assets, the company's flagship MCB project has moved from exploration towards operations which is expected in 2025. This comes with many rewarding challenges which the company is addressing to ensure that timeframes and deliverables are met,” Hume told Proactive.

There are several small caps in the copper mix that could ease supply issues in the next few years.

Sandfire Resources Ltd delivered a strong performance from the MATSA Copper Operations in Spain, with production for the September quarter of 13,747t copper, 19,535t zinc, 2,477t lead and 600,000 ounces silver contained. An updated proved and probable ore reserve estimate was completed for MATSA, setting the foundation for long-term growth.

Expansion of the Motheo Copper Project from 3.2 million to 5.2 million tonnes per annum was also confirmed following the completion of a positive definitive feasibility study (DFS), including the A4 Deposit and an expanded processing plant.

Looking at Solis Minerals Ltd (TSX-V:SLMN, ASX:SLM) Peruvian copper projects, the company received confirmation of grants for a series of largely contiguous tenements totalling 3,200 hectares in the highly prospective southern Peruvian copper belt, some 15 kilometres to the southeast of the world-class Toquepala gold-silver-copper-moly porphyry mine. The new project will be called the Cinto Project.

The Ilo Este (east) Copper Project comprises four contiguous tenements covering an area of approximately 3,200 hectares. They are about 110 kilometres northwest of the town of Tacna. The Ilo Norte Project area consists of eight mining concessions covering a total area of 7,700 hectares approximately 20 kilometres northeast from the Pacific coastal town of Ilo, in the Ilo Province, Department of Moquegua of Sothern Peru.

Aeris Resources Ltd (ASX:AIS) has several copper projects on the go. At its North Queensland operations, it reported copper production of 2,000 tonnes at AISC of A$3.84/lb. It began exploration at the Barbara deposit and approximately 100,000 tonnes of ore was processed at the Ernest Henry mill. Ore processing has been transferred to the Glencore (LON:GLEN) Mt Isa copper concentrator with the next batch (~80,000 tonnes) to be processed in early November. Mt Colin is on track to meet full year guidance.

At its Tritton operations in NSW, it reported copper production of 3,800 tonnes at AISC of A$6.89/lb.

KGL Resources Ltd (ASX:KGL) recently released its feasibility study for the Jervois Copper Project, which is a high-grade project with an initial 11+-year mine life. KGL executive chairman Denis Wood said, “The feasibility study has confirmed the Jervois Copper Project is technically robust and financially viable with a copper price of US$4.23/lb and supports a high-grade copper mine with concentrate production for 11.25 years.

The project is anticipated to come online in 2025 coinciding with the forecast long-term structural deficit in the copper market. Numerous industry analysts are expecting the incentive price required to meet demand to be significantly higher (Goldman Sachs (NYSE:GS) assumes a price of US$5.90/lb).

Castillo Copper Ltd (ASX:CCZ, ASX:CCZ)’s NWQ Copper Project in Queensland has an inferred mineral resource Estimate at 21,886 tonnes of contained copper metal and the Big One Deposit has already been significantly de-risked.

Emmerson Resources Ltd (ASX:ERM) managing director Rob Bills said of its Tennant Creek Project, “Great progress continues across several fronts at Tennant Creek during the quarter. The Hermitage project continues to grow and deliver exceptional grades of gold, copper, bismuth and cobalt. This style of iron-oxide copper-gold (IOCG) mineralisation is associated with a brecciated, sub vertically plunging, tabular orebody that has yet to be closed off by drilling.”

Legend Mining Ltd.’s Rockford Project in the Fraser Range in WA is considered prospective for mineralisation styles including magmatic nickel-copper, VMS zinc-copper-silver and structurally controlled gold.

Orion Minerals Ltd (ASX:ORN, JSE:ORN)’s managing director and CEO Errol Smart said of ORN’s copper projects, “Despite a challenging macro-economic backdrop, Orion has taken some important steps towards its goal of establishing two world-class future-facing metals production hubs in South Africa’s Northern Cape.

“The key highlight has been the strategic funding arrangements we have secured with South Africa’s Industrial Development Corporation, both at our flagship Prieska Project and at our Okiep Copper Project in the Northern Cape.”

At Australian Gold and Copper Ltd (ASX:AGC)’s Cargelligo Project, the Achilles target saw further geological interpretation works ongoing. Consulting petrologist Carol Simpson, who specialises in volcanic terrains within the copper-rich Cobar Basin, delivered a report and presentation on 27 samples from Achilles diamond and RC holes. The report confirmed the fertility of Achilles when compared to other major deposits within the Cobar Basin.

Cooper Metals Ltd (ASX:CPM) recently started a follow up drilling campaign at the Mt Isa East Copper-Gold Project, to test the significant shallow copper and gold mineralisation intersected at King Solomon 1 and commencement of the first ever drilling at the nearby Python Prospect.

QMines Ltd (ASX:QML) recently provided an update on exploration and resource drilling operations at its flagship Mt Chalmers Copper and Gold Project, 17 kilometres northeast of Rockhampton, Queensland.

QMines executive chairman Andrew Sparke said, “We are extremely pleased with the recent results from Woods Shaft which demonstrate the quality of the Mt Chalmers project and its development potential. The company has already delivered two resources since listing in May 2022 and has a further two planned in the coming months, with the Mt Chalmers Resource upgrade expected imminently.”

As for Celsius, its operations in the Philippines could be a unique differentiator.

“We believe mining in the Philippines is set for a strong renaissance with the government publicly backing mining to drive the economic recovery,” Hume said.

“Finance Secretary Benjamin Diokno recently earmarked the sector as a source for long-term economic growth amid the pandemic.

“In developing this globally significant resource, we believe we have the capacity to create thousands of new jobs which will assist the government to achieve its economic and community objectives.

“Recently listed miner Philex’s push ahead with its Silangan copper-gold mine which includes the development and construction of a mill plant, plus support facilities is a strong demonstration of the confidence of mining in the Philippines.

“Strategic proximity to growth and manufacturing markets of Asia are also an attractive proposition.”

That is just the tip of the iceberg on the small cap front, but perhaps they have a bigger role to play as supply/demand issues begin to crunch.

The final word

Demand for copper is set to quickly increase as the energy transition occurs and China ramps up its production targets.

Those companies that can deliver beyond existing levels, will be the beneficiaries.

The small cap explorers are in play. As are gold miners that are looking to diversify.

Meanwhile. buyers are looking at long-term deals to secure supply.

A new report from Wood Mackenzie estimates that 9.7 million tonnes of new copper supply is needed over 10 years, to meet the targets set out in the Paris Climate Agreement.

It’s a perfect copper storm.

Read more on Proactive Investors AU