By Oliver Gray

Investing.com - Commonwealth Bank Of Australia (ASX:CBA) has announced cash net profit after tax of A$5.15 billion for the half year ended 31 December 2022, citing resilient consumer spending despite growing pressure on homeowners due to rising interest rates and inflation pressures.

The company delivered an interim dividend of $2.10 a share, up from $1.75 in the previous period, while announcing buy-backs of a further A$1 billion.

CBA’s CEO Matt Comyn noted that “We continue to invest in technology and our core businesses to improve customers’ lived experience and to solve their unmet needs. This focus is a key driver of growth in our core deposit and lending volumes to retail and business customers.”

Mr Comyn added “Supporting our customers through rising rates and higher cost of living remains a priority and aligns with our purpose to build a brighter future for all. We are providing personalised support, flexibility and financial assistance for our customers who need it.”

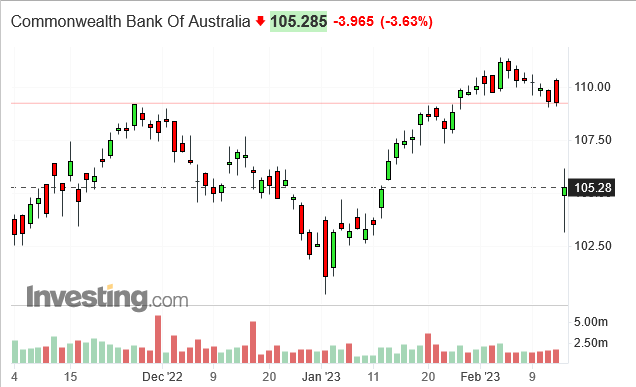

CBA shares were down 3.6% after the report.