Coffee with Samso Episode 180 is with Brett Hazelden, managing director and CEO of OD6 Metals Ltd (ASX:OD6) to talk about the recently released mineral resource estimate for the Splinter Rock Rare Earth Project in Western Australia.

As investors gain a deeper understanding of the rare earth market, it becomes crucial for companies in this sector to demonstrate progress in their endeavours. The recent release of the mineral resource by OD6 is a significant milestone, as it provides tangible evidence of its commitment to delivering value to shareholders.

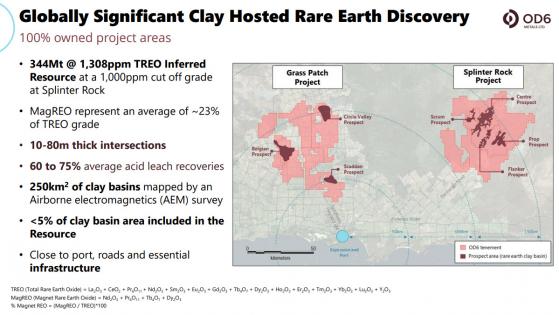

ASX Announcement 18 July 2023 - Splinter Rock Rare Earth Project Maiden Mineral Resource Estimate - 344MTR @ 1,308ppm TREO at a 1,000ppm cut off.

A recap of the OD6 Metals story

OD6 Metals is a company based in the southern region of Western Australia that specializes in Rare Earths Elements (REE). It is situated just north of the town of Esperance. During the time of this Coffee with Samso interview, the company had a market capitalisation of approximately AUD26M, with a share price of around AUD0.25.

OD6 Metals is currently focused on two projects: Grass Patch and Splinter Rock. These projects have undergone drilling campaigns to identify potential resources. The most recent presentation of the company includes Figure 1, which highlights the recent investments made by OD6 Metals.

Figure 1: The current investment highlights for OD6 Metals.

(Source: OD6 Presentation July 2023)

The word according to Brett Hazelden

In this episode of Coffee with Samso, Brett discusses the significance of the Maiden Resource and its role in shaping the OD6 story. The 344Mt @ 1308ppm TREO serves as a baseline for further work in establishing a mining proposition.

It is important to clarify that the Rare Earth players in the market are poised to address any misunderstandings or misinformation. One common misconception in the market is the perceived difference between 'Ionic' and 'Non-Ionic' clay REE deposits. In reality, there is no physical noticeable difference between the two types. The only distinguishing factor is their leaching ability.

Brett provides a clear explanation of why it is crucial for the market to understand that multiple factors contribute to a leachable product. The economics of the entire process must be taken into consideration.

Key points in the unlocking of the downstream process

In my opinion, the main focus of the OD6 Metals story at this stage is the metallurgical aspects of the resource. The recent announcement of the Mineral Resource Estimate (MRE) is a positive step in confirming the existence of the resource and its "good" grade. However, it's important to note that there is still limited factual evidence on the exact grade that will be viable.

The choice of a high cut-off grade indicates that OD6 recognizes the need for a high grade to make the processing economically feasible. This demonstrates the company's understanding that extracting the resource is not an easy task.

Brett's emphasis on the technical challenges involved in extraction is a good sign. During the Coffee with Samso interview, Brett highlights the significance of the high-grade nature of the Splinter Rock Resource. In our industry, we often say "Grade is King" for a reason. The chosen cut-off grade sets a baseline requirement for OD6 to make the project economically viable.

It's commendable that Brett openly discusses the need to balance all parameters, including economics and ESG factors. I appreciate that he doesn't shy away from acknowledging the challenges involved.

Lastly, it's worth noting that the current resource of 344MT @1,308ppm TREO represents only 5% of the total potential in the Splinter Rock project. This means that OD6 Metals still has a significant upside and room for growth.

Samso conclusion

The OD6 story is work in progress with the potential to achieve great success. Let me explain what I mean by that. In a recent Coffee with Samso episode, Brett highlighted the presence of a valuable resource in Splinter Rock. Not only did he emphasize the abundance of this resource, but he also mentioned that it has one of the highest known resource grades.

As the story continues to unfold, the market is still trying to understand the true potential of the "Alluvial" Rare Earth story. It's important to note that this story is still in its early stages, and the final verdict on its success is yet to be determined.

There have been comments suggesting that only an "ionic" style would work, and that the "clay" styles would not be effective. However, based on my conversations with various individuals, I strongly believe that the real story will surprise many.

What I find intriguing is that investors often perceive the business process as rocket science. However, as many Samso followers know, I like to use food analogies. The process of making money in business is no different from selling pancakes or muffins.

The Rare Earth market is now in the spotlight due to the geopolitical situation that demands "Western" sources. This need creates a more realistic opportunity for Esperance to become a region known for Rare Earth production. OD6 is in a prime position to capitalise on this opportunity, thanks to its large resource and high-grade nature.

Balancing the leachability and the cost of extraction is a matter of time and careful consideration. It's important for investors to remember that mining is a long-term endeavor, measured in years and decades. Successful individuals like Warren Buffett invest with a long-term perspective, and that's why we often quote them.

Chapters:

00:00 Start

00:20 Introduction

01:19 Splinter Rock Mineral Resource

01:55 1000ppm cutoff grade at Splinter Rock

04:40 How should investors look at the Maiden Mineral Resource?

05:55 Is the extraction process the more important discussion?

12:58 The larger the volume, the larger the area?

14:30 How much bigger can the resource get in terms of numbers?

17:49 The challenge of the mining sector

22:22 The geological consistency of the MagREO percentage

23:50 The significance of the hosting base rock in terms of chemistry

24:33 Possibility of grade variability?

26:13 Discussion about the rare earths market

27:19 The cost of mining soft rock and hard rock

29:03 Discussion about the current equity market

31:32 News flow

35:26 Main takeaway about the Maiden Mineral Resource

38:43 Conclusion

PODCAST

About Brett Hazelden

Managing Director & Chief Executive Officer

BSc, MBA, AICD

Hazelden is a Metallurgist who brings over 25 years’ experience serving the Australasian resources industry. His experience includes being a Company Director, Managing Director, CEO, Project Manager, Study Manager and originally a Metallurgist in an operating environment.

He brings a diverse range of capabilities from exploration, project development studies, research and development, project approvals, offtake agreements, equity raising, debt financing plus mergers and acquisitions. He has worked across multiple commodities including potash, gold, copper, zinc, lead, iron ore, tungsten, salt, diamond and now rare earth sectors. Most recently, Brett was the Co-founder and Managing Director/CEO of Kalium Lakes (Kalium Lakes Ltd (ASX:KLL)).

Hazelden was appointed as a Director on 1 April 2022.

He is not considered to be an independent Director as he is engaged in an executive capacity.

About OD6 Metals

OD6 Metals is an Australian public company with a purpose to pursue exploration and development opportunities within the resources sector. The Company holds a 100% interest in the Splinter Rock Project and Grass Patch Project which are located in the Goldfields-Esperance region of Western Australia, about 30 to 150km north of the major port and town of Esperance.

The projects are considered prospective for clay rare earth elements (REEs), with the Company’s aim of delineating and defining economic resources and reserves to develop into a future revenue generating operational mine. Clay REE deposits are currently economically extracted in China who is the dominant world producer.

Rare earth elements (in particular, Nd and Pr), are becoming increasingly important in the global economy, with uses including advanced electronics, permanent magnets in electric motors and electricity generators (such as wind turbines) and consumer electronics.

Why OD6 Metals?

- Emerging REE major new clay province in WA, potentially competitive with China’s deposits.

- Dominant land position with over 4,800 km2

- Located close to Esperance port, sealed roads and renewable energy infrastructure.

- Extensive Clay REE in 10 to 37m thick blanket over very large areas .

- Wide intersections of TREO with excellent Nd-Pr concentrations of 20%

- Multiple targets for potentially globally significant REE resources.

- Excellent regional metallurgy.

- Clay REEs are typically low capital intensity and high margin product.

- Significant supply shortage forecast due to rapid demand increase for renewable power, electric vehicles and electronics.

- Critical metals being prioritised by Governments around the world (need for diversity of supply away from China).

Please let Samso know your thoughts and send any comments to info@Samso.com.au. Remember to Subscribe to the YouTube Channel, Samso Media and the mail list to stay informed and make comments where appropriate. Other than that, also feel free to provide a Review on Google (NASDAQ:GOOGL).

For further information about Coffee with Samso and Rooster Talks visit: www.samso.com.au

About Samso

Samso is a renowned resource among the investment community for keen market analysis and insights into the companies and business trends that matter.

Investors seek out Samso for knowledgeable evaluations of current industry developments across a variety of business sectors and considered forecasts of future performances.

With a compelling format of relaxed online video interviews, Samso provides clear answers to questions they may not have the opportunity to ask and lays out the big picture to help them complete their investment research.

And in doing so, Samso also enables companies featured in interviews to build valuable engagement with their investment communities and customers.

Headed by industry veteran Noel Ong and based in Perth, Western Australia, Samso’s Coffee with Samso and Rooster Talk interviews both feature friendly conversations with business figures that give insights into Australian Stock Exchange (ASX) companies, related concepts and industry trends.

Noel Ong is a geologist with nearly 30 years of industry experience and a strong background in capital markets, corporate finance and the mineral resource sector. He was founder and managing director of ASX-listed company Siburan Resources Limited from 2009-2017 and has also been involved in several other ASX listings, providing advice, procuring projects and helping to raise capital.

He brings all this experience and expertise to the Samso interviews, where his engaging conversation style creates a relaxed dialogue, revealing insights that can pique investor interest.

Noel Ong travels across Australia to record the interviews, only requiring a coffee shop environment where they can be set up. The interviews are posted on Samso’s website and podcasts, YouTube and other relevant online environments where they can be shared among investment communities.

Samso also has a track record of developing successful business concepts in the Australasia region and provides bespoke research and counsel to businesses seeking to raise capital and procuring projects for ASX listings.

Disclaimer

The information contained in this article is the writer’s personal opinion and is provided for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. Read full disclaimer.

Read more on Proactive Investors AU