Coffee with Samso Episode 166 is with Mike Haynes, managing director and CEO of New World Resources Ltd (ASX:NWC).

Just over 12 months ago, we had New World Resources with us talking about the Antler VMS project. This story has now moved onto the scoping study stage with a new resource.

Investors in the Australian Stock Exchange (ASX) are struggling to find a decent copper story. The last company that was not considered a major has now been taken over and that was Oz Minerals Limited (ASX: OZL). Oz Minerals was no minnow so there is a big gap in the market.

The next level brings Sandfire Resources NL (ASX:SFR) into the discussion. Aeris Resources Ltd (ASX:AIS) is another "small" copper producer on this scale. From here, the discussion pretty much ends.

Here lies the opportunity to look at companies that have a long life and the potential to make that dream come true. The New World Resources story is a very convincing one as you watch and listen to Mike Haynes talk about the scoping study results.

As all investors have experienced, what is clearly obvious becomes not so clear-cut as time goes by. It is for this reason that I encourage readers and viewers to DYOR and seek out Mike Haynes. Send him the questions.

As I am researching New World Resources, I am struck by the great numbers coming out of the Scoping Study. This episode of Coffee with Samso is all about why the Antler project is so unique in grade and resource.

Check out this Coffee with Samso with Mike Haynes from New World Resources.

Chapters:

00:00 Start

00:20 Introduction

01:16 Recap of the Antler Copper Project.

07:03 How is the geology?

09:17 Good grade numbers.

11:31 Explaining the share price to investors.

14:50 The high grade variation issue.

16:43 Scoping Study results.

17:58 How good is the Antler Copper project in terms of numbers?

24:54 Any potential hiccups?

26:46 How much movement will we see in the numbers?

30:13 Any concerns about future funding?

34:38 News flow.

36:45 Why New World Resources Limited?

37:28 Conclusion

PODCAST

About Mike Haynes

Managing Director and CEO

Mr Haynes has more than 25 years’ experience in the international resources industry. He graduated from the University of Western Australia with an honours degree in geology and geophysics and has explored a wide variety of ore deposit styles throughout Australia and extensively in Southeast and Central Asia, Africa, Europe, South and North America.

Mr Haynes has held technical positions with both BHP (ASX:BHP) Minerals and Billiton plc. He has worked extensively on project generation and acquisition throughout his career. During the past 13 years he has been intimately involved in the incorporation and initial public offerings of numerous resources companies, and in the ongoing financing and management of those and other companies.

About New World Resources Limited

New World Resources Limited is an Australian company focused on the exploration and development of mineral resources projects in North America.

It is listed on the Australian Securities Exchange under the code NWC.

On 14 January 2020 New World Resources Limited announced that it had executed an agreement that provides it with the right to acquire a 100% interest in the high-grade Antler Copper Deposit in Arizona, USA.

Location and Infrastructure

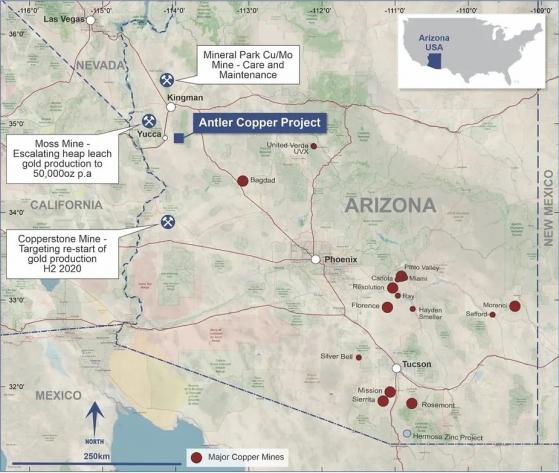

- The Antler Copper Project is located in a sparsely populated region of north-western Arizona (see Figure 1).

- Access to the Project area is excellent; with direct access to the historical mine site by way of 20km of unsealed road that extends east from the town of Yucca (population approximately 6,000) which is on US interstate 40. A rail line passes through Yucca as well as Kingman (population 30,000), some 30km to the north.

- The close proximity of good roads and utilities will be advantageous when exploring and developing the Project; affording opportunities to minimise operating costs and lower pre-production capital requirements.

- The Antler Deposit lies within two (2) patented (private) mining claims that cover 40 acres. The Deposit is surrounded by an additional seven (7) unpatented (BLM) mining claims that cover a further 340 acres.

Figure 1. Location of Antler Copper Project in Arizona, USA.

Geology and Mineralisation

The Antler Deposit lies within a NE-trending belt of Precambrian gneissic and schistose rocks thought to have originally been volcanic in origin. The Deposit comprises a stratabound, pyrrhotite-rich, copper-zinc volcanogenic massive sulphide (“VMS”) body. Numerous other VMS deposits, in similarly-aged rocks, are present in northern Arizona. These include the United Verde Deposit – where 33Mt of ore was mined between 1883 and 1975 at a grade of 4.8% Cu, and the UVX Deposit – where 3.9Mt of ore was mined between 1915 and 1992 at a grade of 10.2% Cu (see Figure 1).

Mineralisation at the Antler Deposit outcrops over more than 750m of strike at surface. The host sequence strikes in a north-easterly direction and dips to the northwest. A complex array of tight folds has been mapped, and two north-westerly trending faults have been mapped to offset and truncate the Antler Deposit (see Figure 2).

Figure 2. Mapped geology at the Antler Copper Project in Arizona, USA, including all previous surface drilling.

Historical Production

The Antler Deposit was discovered in the late 1800s. Intermittent production from the Deposit between 1916 and 1970 totalled approximately 70,000 tonnes of ore at a grade of around 2.9% Cu, 6.9% Zn, 1.1% Pb, 31 g/t Ag and 0.3 g/t Au. Ore was extracted over approximately 200m of strike from an inclined shaft, to a depth of around 150m (see Figures 3-5). The average thickness of ore was reported to be around 4 metres. Additional underground workings were developed to a depth of 200m – but no production was recorded from the deeper levels.

Remnant Mineralisation

Previous mining operations deliberately targeted the highest-grade mineralisation; with stoping undertaken only where such mineralisation was thickest. Accordingly, considerable mineralisation remains, unmined, at very shallow levels immediately adjacent to historical stopes.

Between 1970 and 1975, following completion of the most recent episode of mining, a total of 19 holes were drilled from the surface and underground with the objectives being to:

- increase confidence in the known mineralisation immediately below the mined levels (predominantly below the “7 Level” which was developed 150m below below surface) in advance of anticipated resumption of mining; and

- explore for additional mineralisation.

- 9.66m @ 3.57% Cu, 6.63% Zn, 0.82% Pb, 34.4 g/t Ag and 0.34 g/t Au (U30);

- 7.62m @ 2.80% Cu, 7.29% Zn, 1.61% Pb, 43.4 g/t Ag and 0.54 g/t Au (DDH12);

- 5.18m @ 2.90% Cu, 12.58% Zn, 2.08% Pb, 63.1 g/t Ag and 0.42 g/t Au (U16);

- 7.62m @ 2.47% Cu, 3.52% Zn, 2.81% Pb, 64.5 g/t Ag and 0.46 g/t Au (B-3); and

- 6.40m @ 1.51% Cu, 10.69% Zn, 1.95% Pb, 52.1 g/t Ag and 0.29 g/t Au (U18).

For further information about Coffee with Samso and Rooster Talks visit: www.samso.com.au

About Samso

Samso is a renowned resource among the investment community for keen market analysis and insights into the companies and business trends that matter.

Investors seek out Samso for knowledgeable evaluations of current industry developments across a variety of business sectors and considered forecasts of future performances.

With a compelling format of relaxed online video interviews, Samso provides clear answers to questions they may not have the opportunity to ask and lays out the big picture to help them complete their investment research.

And in doing so, Samso also enables companies featured in interviews to build valuable engagement with their investment communities and customers.

Headed by industry veteran Noel Ong and based in Perth, Western Australia, Samso’s Coffee with Samso and Rooster Talk interviews both feature friendly conversations with business figures that give insights into Australian Stock Exchange (ASX) companies, related concepts and industry trends.

Noel Ong is a geologist with nearly 30 years of industry experience and a strong background in capital markets, corporate finance and the mineral resource sector. He was founder and managing director of ASX-listed company Siburan Resources Limited from 2009-2017 and has also been involved in several other ASX listings, providing advice, procuring projects and helping to raise capital.

He brings all this experience and expertise to the Samso interviews, where his engaging conversation style creates a relaxed dialogue, revealing insights that can pique investor interest.

Noel Ong travels across Australia to record the interviews, only requiring a coffee shop environment where they can be set up. The interviews are posted on Samso’s website and podcasts, YouTube and other relevant online environments where they can be shared among investment communities.

Samso also has a track record of developing successful business concepts in the Australasia region and provides bespoke research and counsel to businesses seeking to raise capital and procuring projects for ASX listings.

Disclaimer

The information contained in this article is the writer’s personal opinion and is provided for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. Read full disclaimer.

Read more on Proactive Investors AU