Coffee with Samso Episode 181 is with Heavy Rare Earths Ltd (ASX:HRE) executive director Richard Brescianini.

The HRE story is a management-focused project led by Richard Brescianini, a highly experienced operator in the REE industry, and people like him are few and far between. His insights into the sector are extremely valuable, especially considering the lack of visibility to non-China related industries. Richard's time with Arafura Resources Limited is invaluable to the company.

In this episode, you will get to know Richard and understand his thinking process as he drives the current project forward. Speaking with Richard, it becomes clear that he operates on a different wavelength. Viewers of Coffee with Samso should take away the fact that Richard is a skilled practitioner in a complex industry with its fair share of secrets.

Richard has personally visited the factories that produce magnets and has engaged with both factories and refineries competing in an economy controlled by a State. It is interesting to note that while the Chinese State acts as the ultimate puppeteer, they also foster fierce competition within the sector to drive productivity.

The HRE story

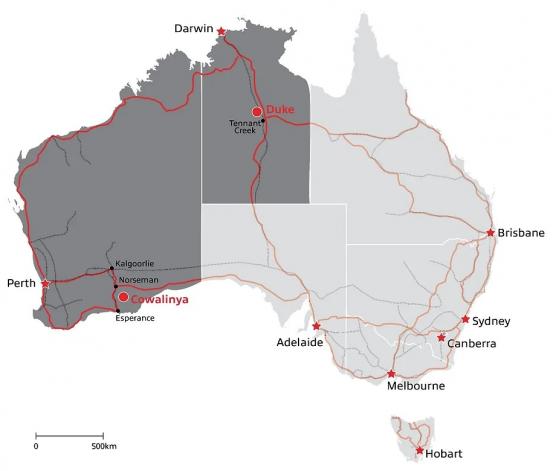

The story of Heavy Rare Earths Limited (Heavy Rare Earths Ltd (ASX:HRE)) is all about the Cowalinya project in Western Australia. The project is located 70km south-east of Norseman, a small gold mining town 187km directly south of Kalgoorlie.

Figure 1: Location of the Cowalinya project in Western Australia. (Source: Heavy Rare Earths Limited)

The Cowalinya area was primarily chosen on the basis of historical drilling which indicated the presence of anomalous rare earths in fresh bedrock and higher grade supergene concentrations of rare earths in the overlying in-situ weathered saprolite profile.

Samso's conclusion

Over the past 24 months, the Samso platform has had the privilege of showcasing a series of Clay Rare Earth stories. It has truly demonstrated why Samso's stories are effective and educational, and pique investor interest. The complexity of understanding the Clay REE business is precisely why the Coffee with Samso conversations with experts like Richard Brescianini are so valuable.

In the case of Heavy Rare Earth, Richard emphasises the importance of leaching the REE out with acids and finding the right balance between cost and profits.

Essentially, the market price needs to be higher than the cost of extracting the metals. Richard's extensive industry experience and understanding of the complexities behind the scenes in China give him a unique advantage that his peers may not possess.

One key takeaway from these conversations is that there is no longer any doubt about the ability to extract the metals. Numerous companies have released metallurgical results showing successful extraction. The focus now shifts to having the necessary resources, grade, and ingredients to make things happen. If someone discovers a more efficient method to extract a greater amount of metals from any grade, it would be a game-changer.

It appears that the HRE resource will be substantially upgraded, with a higher grade than initially stated. The REE business is a long-term game, and wise investors should do their own research (DYOR) and consider long-term investment strategies.

Looking ahead, a potential partnership in non-China based downstream operations could be the next step for HRE. This would add further value to the process. The Esperance region is an ideal location for such partnerships, especially if non-China economies aim to establish a stronger foothold in the supply of REE and manufacturing. It would be a logical decision for the Australian government to support the creation of value-adding industries in this area.

Chapters:

00:00 Start

00:20 Introduction

00:43 Who is Richard Brescianini?

01:36 All about HRE

02:50 The HRE advantage in terms of metallurgy

10:01 Is there a geological control on the grade?

14:07 Is it all about labs now?

18:30 Ionic or non-ionic are not deal-breakers

22:34 Game changer in the clay sector

25:31 Importance of geological advantage

29:13 Future demand of the REE market

32:47 What needs to go right for HRE and what could go wrong for the likes of HRE?

39:20 The positives and negatives of the market

45:45 Economics in the REE market

49:41 News flow

52:27 Why HRE?

57:16 Conclusion

PODCAST

About Richard Brescianini

Executive Director

Richard commenced his career in mineral exploration with BHP (ASX:BHP) Minerals in 1987 working in teams focused on the discovery of base and precious metal deposits across Australia and North America from offices in Brisbane, Perth, Toronto and Denver.

Richard’s experience extends further, including his time working as the Director of the Northern Territory Government’s Geological Survey in Darwin, and being part of the executive management team for rare earths developer, Arafura Resources.

About Heavy Rare Earths Limited (ASX: HRE)

Heavy Rare Earths Limited (Heavy Rare Earths Ltd (ASX:HRE)) is an Australian rare earth exploration and development company. Rare earth materials are used in a wide array of technology and future facing applications, including smart phones, wind energy, and hybrid and electric vehicles.

HRE’s key exploration project is Cowalinya, near Norseman in Western Australia. This is a clay-hosted rare earth project with a JORC Inferred Resource of 28Mt @ 625ppm TREO and a desirable rare earth composition where 25% are the valuable magnet rare earths and 23% the strategic heavy rare earths.

The company has completed a 441 drill hole program confirming widespread occurrence of shallow, thick and/or high grade rare earth mineralisation. The Company anticipates a Mineral Resource update and an estimate Exploration Target (NYSE:TGT) for the project in Q3 2023

Cowalinya Project - Western Australia

The Cowalinya rare earth project is located 70 km south-east of Norseman in Western Australia. It comprises a single 230 km2 exploration licence E63/1972 on unallocated crown land hosting dominantly granitic type rocks in the Central Biranup Zone of the Albany Fraser Orogen. (See Figure 1 above)

The mineralisation being targeted is shallow, flat lying, supergene concentrations of rare earths present in the weathering profile overlying granitic basement. This mineralisation is similar in style to southern Chinese ionic rare earth clay deposits, the world’s main source of heavy rare earths. Although this type of rare earth deposit is low grade, low-cost open pit mining and simple inexpensive metallurgy make them profitable to exploit.

The Cowalinya area was primarily chosen on the basis of historical drilling which indicated the presence of anomalous rare earths in fresh bedrock and higher grade supergene concentrations of rare earths in the overlying in-situ weathered saprolite profile.

In June 2021 HRE drilled 109 aircore holes at Cowalinya by HRE discovered significant supergene concentrations of rare earths in two areas, Cowalinya South and North. The rare earths mineralisation, occurring as flat lying sheets within the in-situ clay-rich weathered saprolite, is contained within an average ~8-9 m thick layer which starts ~17-18 m below surface.

Independent resource consultant JMCT Consulting was engaged to prepare and report Cowalinya’s maiden Inferred Mineral Resource estimate for the project in accordance with the 2012 JORC Code: 28 Mt @ 625 ppm TREO (Total Rare Earth Oxides) using a 300 ppm TREO-Cerium Oxide (CeO2) cut-off grade. Importantly, the resource has a desirable rare earths composition where 25% are the valuable magnet rare earths and 23% the strategic heavy rare earths, and very low average concentrations of radioelements (15 ppm ThO2, 5 ppm U3O8).

Mr John Tyrrell of JMCT Consulting is the Competent Person for the Cowalinya Mineral Resource estimate (in accordance with 2012 JORC Code). TREO = La2O3+CeO2+Pr6O11+Nd2O3+Sm2O3+Eu2O3+Gd2O3+Tb4O7+Dy2O3+Ho2O3+Er2O3+Tm2O3+Yb2O3+Lu2O3+Y2O3. Magnet REOs = Pr6O11+Nd2O3+Tb4O7+Dy2O3 ; Totals may not add due to rounding ; Reported above a TREO-CeO2 cut-off grade of 300 ppm.

The resource at Cowalinya remains open in all lateral directions and currently covers only a small proportion (

Preliminary metallurgical test-work on 40 samples from the 2021 drilling program shows the rare earths are successfully brought into solution using a weak hydrochloric acid leach. Recoveries of >90% for some of the rare earths have been achieved.

Resource exploration and expansion drilling program – 2023

The Company has successfully completed a 441-hole resource exploration and expansion drilling program at Cowalinya (refer to ASX announcements). These assays confirmed the widespread occurrence of shallow, thick and/or high-grade rare earth mineralisation in clay-rich saprolite over a 14 x 3-kilometre area west and south-west of the Cowalinya South deposit (Figure 1). This Western Zone discovery is open to the north and northwest, has an average thickness of 11.3 metres, and includes the following significant drill intercepts (on a grade-thickness basis) reported during the quarter:

- 19 metres @ 3190 ppm TREO from 16 metres (AC225)

- 10 metres @ 2087 ppm TREO from 17 metres (AC221)

- 26 metres @ 1201 ppm TREO from 19 metres (AC360)

- 17 metres @ 1069 ppm TREO from 11 metres (AC223)

- 42 metres @ 790 ppm TREO from 12 metres (AC226)

Please let Samso know your thoughts and send any comments to info@Samso.com.au. Remember to Subscribe to the YouTube Channel, Samso Media and the mail list to stay informed and make comments where appropriate. Other than that, also feel free to provide a Review on Google (NASDAQ:GOOGL).

For further information about Coffee with Samso and Rooster Talks visit: www.samso.com.au

About Samso

Samso is a renowned resource among the investment community for keen market analysis and insights into the companies and business trends that matter.

Investors seek out Samso for knowledgeable evaluations of current industry developments across a variety of business sectors and considered forecasts of future performances.

With a compelling format of relaxed online video interviews, Samso provides clear answers to questions they may not have the opportunity to ask and lays out the big picture to help them complete their investment research.

And in doing so, Samso also enables companies featured in interviews to build valuable engagement with their investment communities and customers.

Headed by industry veteran Noel Ong and based in Perth, Western Australia, Samso’s Coffee with Samso and Rooster Talk interviews both feature friendly conversations with business figures that give insights into Australian Stock Exchange (ASX) companies, related concepts and industry trends.

Noel Ong is a geologist with nearly 30 years of industry experience and a strong background in capital markets, corporate finance and the mineral resource sector. He was founder and managing director of ASX-listed company Siburan Resources Limited from 2009-2017 and has also been involved in several other ASX listings, providing advice, procuring projects and helping to raise capital.

He brings all this experience and expertise to the Samso interviews, where his engaging conversation style creates a relaxed dialogue, revealing insights that can pique investor interest.

Noel Ong travels across Australia to record the interviews, only requiring a coffee shop environment where they can be set up. The interviews are posted on Samso’s website and podcasts, YouTube and other relevant online environments where they can be shared among investment communities.

Samso also has a track record of developing successful business concepts in the Australasia region and provides bespoke research and counsel to businesses seeking to raise capital and procuring projects for ASX listings.

Disclaimer

The information contained in this article is the writer’s personal opinion and is provided for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. Read full disclaimer.

Read more on Proactive Investors AU