Coffee with Samso Episode 159 is with Barry Cahill, executive director of Cyprium Metals Ltd (ASX:CYM).

In this episode with Cyprium Metals, we are recapping on the journey since we last spoke earlier this year. I have Barry Cahill sharing with us all aspects of the company's activities and its continued struggle to finance the Nifty Copper mine.

Barry focuses on the reasons why Cyprium Metals Limited is the leader of the pack in terms of upcoming Copper producers. When we look around the ASX, there is a large gap between the large producers such as BHP (ASX:BHP) (BHP Group Ltd (LSE:BHP, ASX:BHP)) and the recently bought Oz Minerals.

There is a big gap in between, and the current breed of mid cap producers is largely missing. There was Austral Resources Limited which was doing some ore moving but that has gone a bit quiet.

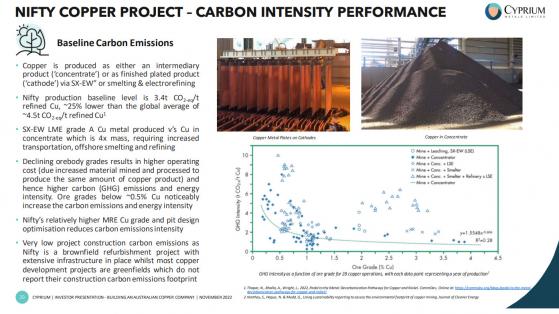

There is no doubt that the quest to be the next producer is not easy. One topic that has largely gone unnoticed about the Copper miners is the difference between a producer who goes to Copper sheet (Cyprium Method) and the traditional refinery route. The diagram below, which is taken straight out of Cyprium's presentation, shows why Cyprium is different.

Why Cyprium is different.

The Cyprium Nifty project has a lot of benefits in reducing cost and carbon emissions as it is a brownfield refurbishment project with extensive assets already in place.

Get yourself comfortable and listen to Barry telling us the journey, good and bad, since we last spoke to him in March 2022.

Chapters

00:00 Start

00:20 Introduction

01:14 Recap of Cyprium Metals Limited.

04:23 Other projects: Maroochydore Copper Project.

05:44 Murchison Copper Project.

08:24 Nifty Copper Project.

11:22 Financing the project.

13:14 Project approvals.

14:11 Current stage: Finance process.

17:13 Explaining to investors about the resource base.

20:47 Knowledge from past experiences.

26:03 The ESG component of copper.

28:35 Discussion about ESG funds.

33:51 Are there any issues faced?

36:54 Importance of inventory.

45:19 What is the step forward?

53:13 Any last words?

56:34 Conclusion

PODCAST

About Barry Cahill

Executive Director

Mr. Cahill is a mining engineer with over 30 years’ experience in exploration, operational mining and management. In particular, his experience covers management of project development and construction from exploration drilling through project funding, commissioning and development. He was the Managing Director of Finders Resources Limited from 2013 until its takeover in 2018. Mr. Cahill has previously been Executive Director of a number of public companies including Operations Director at Perilya Limited and Managing Director of Australian Mines Limited and Norseman Gold Plc.

About Cyprium Metals Ltd

Cyprium Metals Ltd is an ASX listed company with copper projects in Australia. The Company has a highly credentialed management team that is experienced in successfully developing sulphide heap leach copper projects in challenging locations. The Company’s strategy is to acquire, develop and operate mineral resource projects in Australia which are optimised by innovative processing solutions to produce copper metal on-site to maximise value.

The Company has projects in the Murchison and Paterson regions of Western Australia that is host to a number of base metals deposits with copper and gold mineralisation.

Paterson Copper Projects

This portfolio of copper projects comprises the Nifty Copper Mine, Maroochydore Copper Project and Paterson Exploration Project.

The Nifty Copper Mine (“Nifty”) is located on the western edge of the Great Sandy Desert in the north-eastern Pilbara region of Western Australia, approximately 330km southeast of Port Hedland. Nifty contains a 2012 JORC Mineral Resource of 732,200 tonnes of contained copper (i). Cyprium is focussed on a heap leach SX-EW operation to retreat the current heap leach pads as well as open pit oxide and transitional material. Studies will investigate the potential restart of the copper concentrator to treat open pit sulphide material.

The Maroochydore deposit is located ~85km southeast of Nifty and includes a shallow 2012 JORC Mineral Resource of 486,000 tonnes of contained copper (ii). Aeris Resources Limited (ASX: AIS, formerly Straits Resources Limited) holds certain rights to “buy back up to 50%” into any proposed mine development in respect of the Maroochydore Project, subject to a payment of 3 times the exploration expenditure contribution that would have been required to maintain its interest in the project.

An exploration earn-in joint venture has been entered into with IGO Limited (ASX:IGO) on ~2,400km2 of the Paterson Exploration Project. Under the agreement, IGO is to sole fund $32 million of exploration activities over 6.5 years to earn a 70% interest in the Paterson Exploration Project, including a minimum expenditure of $11 million over the first 3.5 years. Upon earning a 70% interest, the Joint Venture will form and IGO will free-carry Paterson Copper to the completion of a pre-feasibility study (PFS) on a new mineral discovery.

Murchison Copper-Gold Projects

Cyprium has an 80% attributable interest in a joint venture with Musgrave Minerals Ltd (ASX:MGV, OTC:MGVMF) at the Cue Copper-Gold Project, which is located ~20km to the east of Cue in Western Australia. Cyprium will free-carry the Cue Copper Project to the completion of a definitive feasibility study (DFS). The Cue Copper-Gold Project includes the Hollandaire Copper-Gold Mineral Resources of 51,500 tonnes contained copper (iii), which is open at depth. Metallurgical test-work has been undertaken to determine the optimal copper extraction methodology, which resulted in rapid leaching times (refer to 9 March 2020 CYM announcement, “Copper Metal Plated”, https://cypriummetals.com/copper-metal-plated/).

The Nanadie Well Project is located ~650km northeast of Perth and ~75km southeast of Meekatharra in the Murchison District of Western Australia, within mining lease M51/887. The Cue and Nanadie Well Copper-Gold projects are included in an ongoing scoping study, to determine the parameters required to develop a copper project in the region, which provides direction for resource expansion work.

Please let Samso know your thoughts and send any comments to info@Samso.com.au. Remember to Subscribe to the YouTube Channel, Samso Media and the mail list to stay informed and make comments where appropriate. Other than that, also feel free to provide a Review on Google (NASDAQ:GOOGL).

For further information about Coffee with Samso and Rooster Talks visit: www.samso.com.au

About Samso

Samso is a renowned resource among the investment community for keen market analysis and insights into the companies and business trends that matter.

Investors seek out Samso for knowledgeable evaluations of current industry developments across a variety of business sectors and considered forecasts of future performances.

With a compelling format of relaxed online video interviews, Samso provides clear answers to questions they may not have the opportunity to ask and lays out the big picture to help them complete their investment research.

And in doing so, Samso also enables companies featured in interviews to build valuable engagement with their investment communities and customers.

Headed by industry veteran Noel Ong and based in Perth, Western Australia, Samso’s Coffee with Samso and Rooster Talk interviews both feature friendly conversations with business figures that give insights into Australian Stock Exchange (ASX) companies, related concepts and industry trends.

Noel Ong is a geologist with nearly 30 years of industry experience and a strong background in capital markets, corporate finance and the mineral resource sector. He was founder and managing director of ASX-listed company Siburan Resources Limited from 2009-2017 and has also been involved in several other ASX listings, providing advice, procuring projects and helping to raise capital.

He brings all this experience and expertise to the Samso interviews, where his engaging conversation style creates a relaxed dialogue, revealing insights that can pique investor interest.

Noel Ong travels across Australia to record the interviews, only requiring a coffee shop environment where they can be set up. The interviews are posted on Samso’s website and podcasts, YouTube and other relevant online environments where they can be shared among investment communities.

Samso also has a track record of developing successful business concepts in the Australasia region and provides bespoke research and counsel to businesses seeking to raise capital and procuring projects for ASX listings.

Disclaimer

The information contained in this article is the writer’s personal opinion and is provided for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. Read full disclaimer.

Read more on Proactive Investors AU