Coffee with Samso Episode 170 is with Brett Hazelden, managing director and CEO of OD6 Metals Ltd (ASX:OD6).

The space in the rare earth sector is maturing fast and the understanding of the sector is highly sought after by investors and companies. Brett Hazelden is again, giving us a masterclass on all aspects of the Rare Earth Industry.

The Story of OD6 Metals Limited

OD6 Metals is all about rare earth elements (REE) in the southern region of Western Australia. It is located just north of the town of Esperance. As we were doing this Coffee with Samso, the market capitalisation of the company was around AUD26M and the share price was sitting around AUD 0.25.

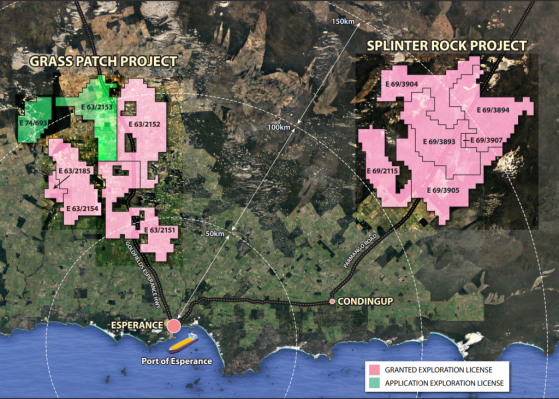

The company is focusing on both the Grass Patch and Splinter Rock project which have both undergone drilling campaigns defining potential resources. The most recent announcements have highlighted the recent activities at both projects.

Figure 1: Project locations for OD6 Metals Limited (source: OD6 Metals).

The word according to Brett Hazelden

For those readers that have been following the Samso platform, you will know that the last two Coffee with Samso has been in this commodity space. The general specifications of the rare earth sector are fundamentally the same.

We all know what the metals do and why they are important. As I have said many times, the key to the clay rare earth sector is all about how to solve the downstream processing. The unlocking of this will open a floodgate of opportunities for both investors and companies.

What are the key points of unlocking the downstream process?

One of the benefits of talking to so many industry leaders is that I am learning all the recent technologies and thinking processes. What the small cap industry excels in is the ability to think fast and nimble to get the story on track.

In the world of rare earth, clay rare earth deposits, there is such a thing as "refractory" and "free leaching" deposits. When I heard that, I had a light bulb moment. My first thought was that companies with free leaching clay deposits will be first cap of the "unlocking" process.

As everything is so new, this is one way of prioritising which company or what to look for in "stories". There are many other factors but I guess this is a great way to understand what companies have in respect to the geology and the potential of future deposits.

Samso conclusion

There is nothing new for OD6 Metals Limited. The path forward is to generate tonnage and grade while they are looking for the answer to the processing part of the equation. The unknown part of the equation is not about the ability to extract rare earth from the clays, as Brett mentioned. The question is what is the process to do this with best practice environmental process that will pass the test of time and the ESG signoff.

The biggest asset that OD6 Metals (apart from the obvious) is that the adjacent assets owned by other companies in the region are also facing the same issue and have similar resources. The collective group is making this region a rare earth province.

I have mentioned previously that my thoughts are that the government conversations indicate to me, that there is a potential of creating a rare earth downstream industry in Australia. The current political rhetoric with the rising China Cold War stance may indeed force the Australian government to react and this would be a great occasion for all those involved in the Southern Region of Western Australia.

Chapters:

00:00 Start

00:20 Introduction

01:13 Who is OD6?

01:54 How has the Airborne Electromagnetic Survey (AEM) worked for OD6.

03:40 OD6 is more about Size than Depth.

04:36 How has your understanding changed?

07:41 Differences between Grass Patch and Splinter Rock.

10:50 Differentiating Refractory styles to Free Leaching Styles of the REE Clays.

14:25 Are the Chinese more Clay or Ionic styles?

19:00 Can Ionic clay be a major commodity industry?

20:23 How much has the rare earth market changed?

22:15 How does the rare earth market situation translate to the equity market?

23:45 Why OD6?

26:39 Current market

27:53 Conclusion

PODCAST

About Brett Hazelden

Managing Director & Chief Executive Officer

BSc, MBA, AICD

Mr Hazelden is a Metallurgist who brings over 25 years’ experience serving the Australasian resources industry. His experience includes being a Company Director, Managing Director, CEO, Project Manager, Study Manager and originally a Metallurgist in an operating environment.

Mr Hazelden brings a diverse range of capabilities from exploration, project development studies, research and development, project approvals, offtake agreements, equity raising, debt financing plus mergers and acquisitions. He has worked across multiple commodities including potash, gold, copper, zinc, lead, iron ore, tungsten, salt, diamond and now rare earth sectors. Most recently, Brett was the Co-founder and Managing Director/CEO of Kalium Lakes (Kalium Lakes Ltd (ASX:KLL)).

Mr Hazelden was appointed as a Director on 1 April 2022.

Mr Hazelden is not considered to be an independent Director as he is engaged in an executive capacity.

About OD6 Metals Limited (ASX: OD6)

OD6 Metals is an Australian public company with a purpose to pursue exploration and development opportunities within the resources sector. The Company holds a 100% interest in the Splinter Rock Project and Grass Patch Project which are located in the Goldfields-Esperance region of Western Australia, about 30 to 150km north of the major port and town of Esperance.

The projects are considered prospective for clay rare earth elements (REEs), with the Company’s aim of delineating and defining economic resources and reserves to develop into a future revenue generating operational mine. Clay REE deposits are currently economically extracted in China who is the dominant world producer.

Rare earth elements (in particular, Nd and Pr), are becoming increasingly important in the global economy, with uses including advanced electronics, permanent magnets in electric motors and electricity generators (such as wind turbines) and consumer electronics.

Why OD6 Metals?

- Emerging REE major new clay province in WA, potentially competitive with China’s deposits.

- Dominant land position with over 4,800 km2

- Located close to Esperance port, sealed roads and renewable energy infrastructure.

- Extensive Clay REE in 10 to 37m thick blanket over very large areas .

- Wide intersections of TREO with excellent Nd-Pr concentrations of 20%

- Multiple targets for potentially globally significant REE resources.

- Excellent regional metallurgy.

- Clay REE’S are typically low capital intensity and high margin product.

- Significant supply shortage forecast due to rapid demand increase for renewable power, electric vehicles and electronics.

- Critical metals being prioritised by Governments around the world (need for diversity of supply away from China).

For further information about Coffee with Samso and Rooster Talks visit: www.samso.com.au

About Samso

Samso is a renowned resource among the investment community for keen market analysis and insights into the companies and business trends that matter.

Investors seek out Samso for knowledgeable evaluations of current industry developments across a variety of business sectors and considered forecasts of future performances.

With a compelling format of relaxed online video interviews, Samso provides clear answers to questions they may not have the opportunity to ask and lays out the big picture to help them complete their investment research.

And in doing so, Samso also enables companies featured in interviews to build valuable engagement with their investment communities and customers.

Headed by industry veteran Noel Ong and based in Perth, Western Australia, Samso’s Coffee with Samso and Rooster Talk interviews both feature friendly conversations with business figures that give insights into Australian Stock Exchange (ASX) companies, related concepts and industry trends.

Noel Ong is a geologist with nearly 30 years of industry experience and a strong background in capital markets, corporate finance and the mineral resource sector. He was founder and managing director of ASX-listed company Siburan Resources Limited from 2009-2017 and has also been involved in several other ASX listings, providing advice, procuring projects and helping to raise capital.

He brings all this experience and expertise to the Samso interviews, where his engaging conversation style creates a relaxed dialogue, revealing insights that can pique investor interest.

Noel Ong travels across Australia to record the interviews, only requiring a coffee shop environment where they can be set up. The interviews are posted on Samso’s website and podcasts, YouTube and other relevant online environments where they can be shared among investment communities.

Samso also has a track record of developing successful business concepts in the Australasia region and provides bespoke research and counsel to businesses seeking to raise capital and procuring projects for ASX listings.

Disclaimer

The information contained in this article is the writer’s personal opinion and is provided for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. Read full disclaimer.

Read more on Proactive Investors AU