Cobre Ltd (ASX:CBE) has raised $5 million in a strongly supported placement to accelerate exploration in the Kalahari Copper Belt in Botswana.

The company also intends to launch a share purchase plan (SPP) to eligible shareholders in Australia and New Zealand to raise up to an additional A$1 million.

The total to be raised through the placement and SPP will be ~A$6.7 million, which is made up of A$6 million cash and ~A$700,000 in scrip for services.

It was an impressive show of support from key shareholders in the placement, which illustrates the confidence in CBE’s projects.

Leading global investment manager Sprott Asset Management invested almost A$2 million into the placement, while Metal Tiger PLC (AIM:MTR, OTC:MRTTF, ASX:MTR), CBE’s largest shareholder, subscribed for its pro rata of A$1 million under the placement and Cobre’s second-largest shareholder, Commodity Discovery Fund, subscribed for A$300,000.

In addition to the placement, CBE’s drilling service provider Mitchell Drilling Botswana and exploration services provider Remote Exploration Services (RES) subscribed for US$400,000 and US$70,000 (respectively) at the placement price, as part of scrip for service arrangements.

“We are pleased to have secured the funds required to accelerate exploration on the company’s tenement holding in the Kalahari Copper Belt in Botswana," Cobre executive chairman Martin Holland said.

"The placement was well supported by our existing and new shareholders, who we thank for supporting the board in delivering on our strategy to fast-track exploration and realise the potential of Cobre’s Botswana tenements.

“With Cobre’s current $4 million in cash at bank, combined with the funds raised through this placement, Cobre will have a total of ~$10 million that will be used to fund a substantial drill program, including two diamond drill rigs and one RC/AC drill rig on site that will be drilling throughout 2023.”

About the placement

Cobre will release approximately 33.3 million new fully paid ordinary shares at an issue price of $0.15 per new share to raise A$5 million.

Funds will be used in conjunction with existing cash to accelerate exploration on CBE’s tenement holding in the Kalahari Copper Belt in Botswana.

The placement was conducted at a price of $0.15 per share representing an:

- 11.8 % discount to the close price of $0.17 on December 15, 2022;

- 18.6% discount to the five-day Volume Weighted Average Price (VWAP) of $0.184; and

- 28.3% discount to the 10-day VWAP of $0.209.

The SPP

Under the SPP, eligible shareholders will be invited to apply to subscribe for up to A$30,000 worth of Cobre shares without the cost of brokerage fees or commissions.

Further information will be released on Wednesday, December 28, 2022.

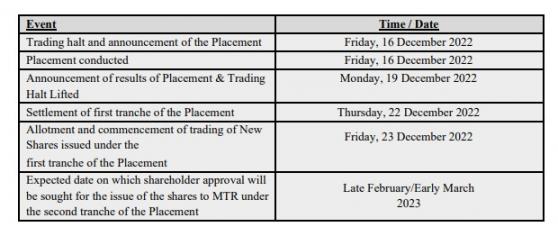

Indicative timetable

Read more on Proactive Investors AU