Cobre Ltd (ASX:CBE) could be sitting on a “substantial scale” copper deposit exceeding 100 million tonnes based on a recently completed conceptual exploration target modelling exercise for the southern anticline at its Ngami Copper Project (NCP) in Botswana.

Results from the modelling exercise, derived from drill-tested mineralisation, geophysical data and geological modelling, indicate the project has a potential scale of between 103 million and 166 million tonnes at 0.38 to 0.46% copper.

“The completed modelling work provides us with a first pass estimate of the significant size and grade of copper mineralisation on the southern anticline structure at NCP … (with) a relatively small drill program required to bring the first circa 23 million tonnes into an inferred category resource,” Cobre chief executive officer Adam Wooldridge said.

“In addition, more than 20 kilometres of untested strike from open-ended targets provides significant blue sky, which is expected to further extend the project scale.”

Exploration target estimate

The exploration target estimate was constructed based on an in-situ copper recovery (ISCR) process utilising a series of injection and recovery wells to pump a weak acid solution under low pressure to dissolve the copper within the ore body.

Independent geological consultants Caracle Creek International Consulting Minres (Pty) Ltd completed the models and estimations based on a database of 78 diamond core drill holes totalling 16,465 metres over the NCP.

The southern anticline focus area includes 49 diamond drill holes covering 40 kilometres across the project with anomalous copper intersections on both fold limbs.

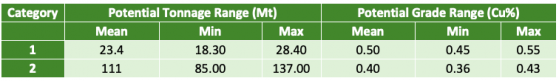

A total of 1,907 multi-element assays, together with lithological logging, structural and physical property measurements were used to construct the models, which were divided into two categories based on the drill data and the potential to extract copper from the deposit using the ISCR process.

Exploration target estimate of tonnage and grade ranges using a 0.2% copper cut-off grade.

The estimates of tonnage and grade are conceptual in nature, there has been insufficient exploration to estimate a mineral resource and it is uncertain if further exploration will result in the estimation of a resource.

Strong ISCR candidate

“Our metallurgical and high-level hydrogeological work indicates that the project is a strong candidate for ISCR, which would provide a cost-effective method for beneficiating the copper from this substantial target with minimal environmental footprint,” Wooldridge said.

“Our next steps along the ISCR journey will involve conducting pump testing to gather detailed hydrogeological information and conducting further metallurgical test work to optimise copper recoveries.”

These include:

- Ongoing metallurgical testing designed to optimise copper recoveries with results expected early in the fourth quarter;

- Pump tests designed to establish the hydraulic connectivity along the mineralisation and prove the viability of an ISCR methodology will begin in the next quarter; and

- Following successful pump test work, a 9,000-metre diamond drill program is planned to start in the first quarter in order to advance the first category of the exploration target to an inferred resource.

Cobre and previous joint-venture partners have spent a total of US$6.5 million on NCP's exploration activities.

Read more on Proactive Investors AU