Cobalt is expected to remain a key raw material for the entire battery supply chain despite the persistent theme of substitution of cobalt in battery applications, according to the Cobalt Institute’s Cobalt Market Report.

It is expected that multiple cell formulations (mostly nickel-cobalt-manganese (NCM) and lithium iron phosphate (LFP)) will support the major end-use sectors, with no single battery cell technology dominating.

Nickel-cobalt chemistries will maintain a large share of demand and a number of recent announcements from major downstream players also reinforce cobalt’s key position in the energy transition.

Market could double by 2030

Cobalt demand is forecast to rise by more than 200,000 tonnes by 2030 with the market size doubling relative to 2022 and approaching 400,000 tonnes – this demand story shows a strong outlook for cobalt despite some efforts to reduce material intensity.

On the supply side, the DRC will continue to play a major role and will contribute 44% of growth by 2030.

This will be closely followed by Indonesia’s rapidly growing cobalt and nickel markets – the country has the potential to support 37% of mined supply growth to 2030 as supply increases 10-fold.

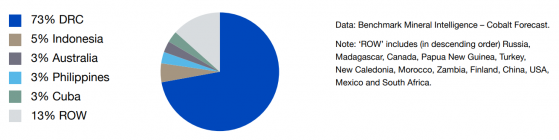

Share of mined cobalt supply in 2022, %.

After becoming the largest end-use sector for cobalt in 2021, electric vehicles (EVs) gained further ground in 2022 and now account for 40% of total cobalt market end-use demand.

Demand share of cobalt end-use sectors in 2022.

EVs alone supported 86% of annual demand growth while the traditional, non-battery applications accounted for just 6% of growth.

Mined supply grew faster in 2022 than in 2021 (21% vs 14% y/y) and approached 200,000 tonnes, alongside easing supply chain constraints.

The DRC remained the major supplier, with a 73% share, and contributed 70% of annual growth.

Indonesia became the second largest producer in 2022, due to the rapid development of domestic nickel-cobalt mines and high-pressure acid leach capacity, overtaking established producers including Australia and the Philippines.

Growth in mined supply by major country in 2022, tonnes of cobalt.

In the spotlight: cobalt stocks

The shift to electric vehicles is increasing the demand for cobalt and this provides attractive opportunities for cobalt players.

Let’s look at some of the uranium explorers and developers making moves in the market.

Celsius Resources Ltd (ASX:CLA, AIM:CLA)’s Opuwo Cobalt Project in Namibia represents a potential, stable cobalt source from a non-conflict country, which could be globally significant.

Opuwo’s 259,000 tonnes of contained cobalt demonstrates the potential for the project to be a significant future supplier of cobalt into the battery market.

Furthermore, its 970,000 tonnes of contained copper will enhance the viability of the project given current and forecast copper prices.

Next steps

Preliminary roasting and tank leach test work results showed encouraging results of 95% cobalt and 98% copper recovery which demonstrate that the Opuwo ore is amenable to roasting and tank leach downstream process method.

Further tests were undertaken on various collectors, including five sets of roasting and 10 subsequent leaching tests to optimise retention times, operating temperatures and reagent consumptions.

Results will be utilised as input criteria to develop a processing flowsheet which will be the basis for an economic scoping study.

Cobalt Blue Holdings Ltd (ASX:COB, OTC:CBBHF) is making strong progress with its integrated Australian cobalt supply strategy with work at present focusing on a refinery development program and a definitive feasibility study (DFS) for the Broken Hill Cobalt Project (BHCP) utilising results from a demonstration plant.

The strategy incorporates a refinery at Kwinana in Western Australia at which cobalt sulphate will be produced for export utilising cobalt from the BHCP in Broken Hill, Far West New South Wales.

This comes at a time of increased focus in the US and Europe on developing critical minerals supply chains to serve the burgeoning electric vehicle and clean, green energy sectors.

Corazon Mining Ltd (ASX:CZN, OTC:CRZNF) recently received further positive metallurgical test-work results from its Lynn Lake nickel-copper-cobalt sulphide project in Manitoba, Canada, where ore-upgrading presents the potential to reduce costs and increase reserves of a future mining operation.

Lynn Lake was successfully mined for 24 years before it was closed in 1976.

The ore at Lake Lynn was historically processed via conventional flotation, which delivered very good recoveries for nickel, copper and cobalt. Corazon has since achieved improved recoveries and concentrate grades compared to those historically reported.

It’s worth noting that 80% of the current resources are in the measured or indicated JORC category (total contained metal of 116,800 tonnes of nickel, 54,300 tonnes of copper and 5,300 tonnes of cobalt), with much of the resource area drilled out and ready for mining.

Aircore drill assay results released by Sipa Resources Ltd (ASX:SRI) earlier this month have added weight to previously-identified nickel and cobalt mineralisation at the 100%-owned Skeleton Rocks Project in Western Australia.

The exploration company completed twenty holes for 1,064 metres at the Nicoletti and Oetiker 3 prospects, with significant areas left to be tested as drilling was restricted to the paddock margins due to the target area being under crop.

“We continue to methodically explore our tenement package at Skeleton Rocks and have further nickel-copper and pegmatite targets to test once the cropping season is over,” Sipa Resources managing director Pip Darvall said.

Aruma Resources Ltd (ASX:AAJ) managing director Glenn Grayson recently spoke to Thomas Warner from Proactive after the Western Australia-focused mineral exploration company announced it has received some promising rock chip sample results from its Saltwater project in the Pilbara.

Grayson says the samples have revealed high-grade cobalt, reaching up to 0.45% cobalt, making it economically significant. Additionally, the samples contain manganese with levels of up to 40%. The project also uncovered anomalous copper and silver.

Read more on Proactive Investors AU