Investing.com - Analysts from Citi have shared their insights on several companies including Iluka Resources Ltd (ASX:ILU), Sims Metal Management Ltd (ASX:SGM), and Stockland Corporation Ltd (ASX:SGP).

Iluka Resources Ltd (ASX:ILU) is viewed with cautious optimism. Despite an improved outlook for the TiO2 feedstock due to demand in markets outside China, zircon demand within China remains stagnant due to ongoing housing softness.

However, further support for the property sector is expected from China. While price forecasts for mineral sands remain largely unchanged, the analysts have pushed the expected date for the first refinery production into CY27, citing that Iluka is yet to finalize additional funding for increased refinery capital expenditure.

⚠️Enjoy InvestingPro tools and strategies for A$13.9/month thanks to a limited-time discount on the 1-year Pro subscription! CLICK HERE to take advantage before it's too late, and know which stocks to buy and which to avoid no matter the market conditions!⚠️

Sims Metal Management Ltd (ASX:SGM) is seen in a favorable light by Citi analysts despite a challenging 12 months due to scrap steel price fluctuations.

"While ex China steel production is up a modest 1.8% YTD, consumption is up 4.0% with China net steel exports up 28% displacing ex China production," analysts noted in Wednesday's report.

Looking ahead to FY26, the company should be able to generate an EBIT of $345 million, assuming a return to more traditional margins.

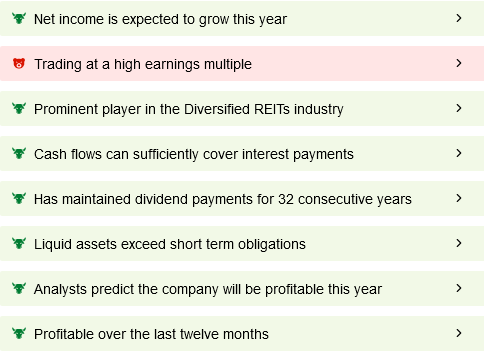

Stockland Corporation Ltd (ASX:SGP) recent land lease partnership with Invesco is expected to generate A$1.1 billion of gross development revenue and includes 1,190 homes.

While the near-term financial impact is limited, Stockland should see profit uplift from vending land into the partnership. This new partnership, in addition to Stockland's existing partnership with Mitsubishi Estates in land lease, should accelerate the growth of the land lease business.

⚠️Enjoy InvestingPro tools and strategies for A$13.9/month thanks to a limited-time discount on the 1-year Pro subscription! CLICK HERE to take advantage before it's too late, and know which stocks to buy and which to avoid no matter the market conditions!⚠️

Over the medium term, Citi analysts see strong growth tailwinds for Stockland from various businesses like retail, logistics, and residential, with additional support from the land lease sector.