It seems the industrial golden age of exponential population and economic growth may be coming to an end.

All around the world, birth rates are falling, and populations are ageing. The structures that once held up our advanced infrastructure, pension schemes and high economic growth are faltering as we speak.

Throughout human history, our populations remained fairly stable – while Empire led to massive booms in human growth throughout the ages, they also brought famine, war and epidemics that regularly reduced our numbers by the thousands, if not millions.

The industrial revolution, and the massive concentration of fuel, food and advanced medicine that resulted from it, changed that dynamic – at least in the short term.

For the last two hundred years human civilisations have expanded at an unprecedented rate – two centuries ago we broke through the 1 billion mark for the first time in our history of some 200,000 years or more.

Today, there are more than 8 billion of us.

In just two hundred years, we have grown used to our mastery of famine and disease – but cultural, social, and economic shifts across the global are pointing to a new reality.

Fortunately for the savvy investor, these global headwinds may provide short-term financial and investment opportunities.

An advanced, ageing world

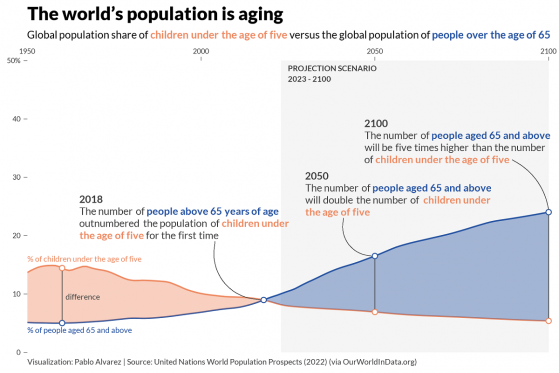

On average, the global population is ageing.

In 2018, the number of people aged 65 years and above outnumbered those under the age of five for the first time in recorded history.

In Japan, Germany, Italy, Hong Kong, Greece and San Marino, the median population is over 45 years old.

In a further 39 countries – including France, Russia, Belgium, Sweden, and the UK – the median age is over 40 years old.

In many of these developed countries, the age of native populations would be even higher; immigration accounts for much of the younger demographics and has done for over a decade now.

While the global population is still increasing in absolute numbers, population growth peaked decades ago.

In real terms, this is already having a marked effect on our economies – less tax dollars, higher healthcare and pensions costs, lower productivity; many advanced nations are already feeling the pinch, and immigration is only a short-term solution as countries continue to industrialise and birth rates fall in step with higher education and better social outcomes.

A faltering workforce

In most economies, younger and middle-aged workers represent the majority of productivity. In contrast, most healthcare and social costs are generated by older demographics, often those already retired.

This dynamic was more than acceptable when there were far more younger people to generate tax to support older people – but that triangle has now inverted.

Compare Australia in 1981, when demographics were already shifting:

Here’s what the same population pyramid looks like today:

As life expectancy increases, and birth rates continue to decline, the top-heavy demographic shift will only continue to compound.

China’s slippery slope

Today, China is experiencing some of the most rapid demographic shift and population decline ever seen.

MLC Asset Management chief investment officer Dan Farmer has succinctly laid the key points out:

- The Seventh National Population Census, published in 2021, revealed that only twelve million babies were born in 2020, the fewest newborns since the horrific Great Leap Forward-related famine of 1961.

- China’s working-age population, aged 16-59, is contracting, falling by 40 million workers since 2010 to less than 900 million today.

- China recorded a net increase of just 480,000 people in 2021, the lowest ever official rate.

- The Shanghai Academy of Social Sciences team predicted an annual average population decline of 1.1% after 2021, pushing China’s population down to 587 million by 2100, less than half of what it is today.

Mortality may soon outpace growth, tipping the country into outright population decline.

Unfortunately, this isn’t an issue that policy can address. No nation on earth has managed to effectively reverse falling birth rates at present, and immigrants from less fortunate countries will soon be outnumbered by the labour requirements of more established economies.

“China’s population has reached a level of education and income where having larger families has lost its appeal,” Dan Farmer writes.

“That is because there are many other factors keeping the birth rate and fertility down, some of which are trends seen in many industrialised and newly industrialised countries.

“Increased participation of women in the workplace and changing attitudes toward marriage means people are less inclined to have children.

“Additionally, the rising cost of living and changing expectations toward quality of life and lifestyles means that people are less willing – and capable – of taking on childrearing responsibilities.

“These are profound structural issues any government would struggle to address. It’s not impossible that China could experience some of what Japan has endured since the bursting of its property and asset bubble more than three decades ago.”

Is it solvable?

Maybe.

Immigration may seem like an obvious solution, but research has shown the fertility rates of immigrants adjust to local levels within three generations.

At present, it’s mostly only countries in Africa, South America, and the Middle East with fertility rates above the replacement value of 2.1.

Global fertility rates:

Keeping countries poor to provide labour to more advanced economies is not a moral nor reasonable solution.

In effect, this problem has come from improved average quality of life (alongside a higher cost of living), which is not something many would accept sacrificing.

Actionable solutions include better and cheaper childcare and housing, financial benefits for parents, and a more positive attitude toward children and families in general.

In essence, the world needs to make it easier, cheaper, and more attractive to have more children.

We may also need to accept that the golden age of constant, unending growth might have already come to an end.

Either way, this isn’t a problem we can ignore – and it may require deep, structural shifts in how our societies and economies function to address.

Short-term opportunities

Interestingly, China’s shifting demographics and transforming economic structure may provide financial and investment opportunities in the short-term.

“Ironically though, potential returns from Chinese shares may be more promising now than in the years when the country’s economy was growing at thumping rates,” Dan Farmer explains.

“Large state-owned enterprises, which are by-and-large inaccessible to investors, drove much of the growth in the go-go years.

“Now, however, small-to-medium sized listed companies are much more to the fore enabling investors to participate in their growth.”

Farmer points to ‘quality companies’ on the Shenzhen Composite Index as potential investment opportunities, while cautioning a need for diversity in investment and a potential shift from long-term investing.

“The last 30 years have been unusually favourable to long-only investors in equities and bonds, and it is plausible the next decade may be bumpier,” Farmer writes.

“This means that identifying global macro and trend following strategies that can make money from being short equities and short bonds at the right time, could potentially benefit our diversified portfolios.”

A more flexible, macro-based investing strategy may serve well in the coming years of demographic-driven uncertainty.

Read more on Proactive Investors AU