The flagship MCB Copper-Gold Project of Celsius Resources Ltd (ASX:CLA, AIM:CLA) has bagged a pivotal environmental compliance certificate (ECC) from the Philippines' Department of Environment and Natural Resources.

This crucial milestone clears the path for a mineral production sharing agreement (MPSA) with the Philippine National Government — a vital step in the precious and base metal project's progression.

The ECC comes soon after Makilala Mining Company, Inc. (a Celsius subsidiary) completed an exhaustive environmental impact assessment, confirming it would roll out a government-endorsed environmental management plan to optimise MCB’s social, cultural and environmental impact.

Ultimately, Celsius believes the certificate strengthens its standing as a responsible mining company, solidifying its commitment to sustainable practices and conscious development in the Philippines.

Beyond responsible mining

Celsius chair Julito Sarmiento said the ECC was a key turning point in the company’s quest to spearhead a more sustainable, inclusive and transformative mining industry.

“Environmental protection has always been one of the primary considerations in the MCB Project’s mine design,” he explained.

“This is not only in strict adherence to the environmental, social and governance standards but also as a firm commitment to our stakeholders and shareholders for the MCB Project to become a model for beyond-responsible mining.

“[We are working] in close partnership with the Department of Environment and Natural Resources under the stewardship of secretary Maria Antonia Yulo-Loyzaga, a globally renowned climate change and disaster resilience expert.”

Developing MCB

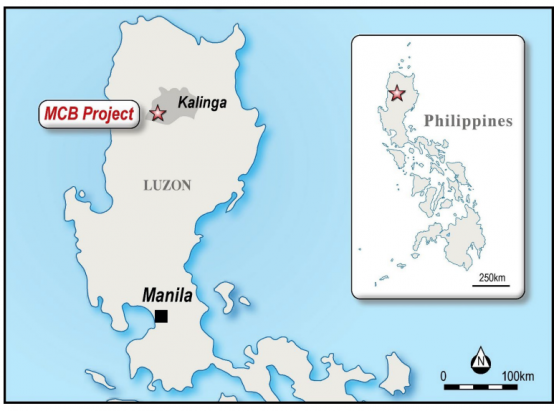

Celsius’ flagship asset, nestled in the Philippines’ Cordillera Administrative Region, has seen years of historical exploration and represents a major focal point in the company’s copper-gold vision.

Roughly 320 kilometres north of Manila, the precious and base metal camp is part of the broader Makilala portfolio, which includes several other key prospects awaiting permit renewals and extensions.

In January 2021, the MCB Project declared its maiden JORC resource estimate, and in December last year, the company updated the spoils to 338 million tonnes at 0.47% copper and 0.12 g/t gold, culminating in 1.6 million tonnes of contained copper and 1.3 million ounces of gold.

On the development front, a late 2021 study revealed there was scope for a 25-year mine life operation, churning out copper and gold via an underground production scenario.

The study forecast a post-tax net present value of US$464 million and a 31% internal rate of return, encapsulated in a payback period of just over two-and-a-half years.

The production design matches a 2.28-million-tonne-per-annum processing plant, projected to treat ore with an average grade of 1.14% copper and 0.54g/t gold over the mine’s first decade.

Aside from US$253 million in initial expenditure, the operation is expected to boast a C1 cash cost of just US$0.73/pound copper, net of gold credits.

Read more on Proactive Investors AU