Celsius Resources Ltd (ASX:CLA) is continuing to define extensive surface high-grade copper mineralisation at the flagship MCB Copper-Gold Project, owned by its Philippine subsidiary Makilala Mining Company Inc.

The latest set of results from drill hole MCB-041 have confirmed the continuity of a large-scale copper footprint in addition to providing greater definition to the higher-grade central core at MCB.

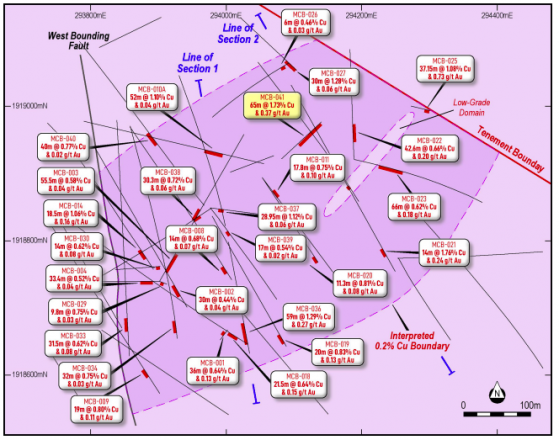

Notably, MCB-041 returned 65 metres at 1.73% copper and 0.37 g/t gold from 66 metres and 10.5 metres at 0.69% copper and 0.07 g/t gold from 19.5 metres, complementing discoveries from 2021 to 2022 and validating the historical drilling information completed by Freeport-McMoRan.

Significantly, MCB-041 has extended the higher-grade copper mineralisation envelope near the surface further to the east.

Location of MCB-041 relative to recent and historical diamond drilling at MCB.

Feasibility study boost

Celsius country operations director Peter Hume said: “Our drilling strategy was modified in 2022 to shift the focus from deep targets to the recently identified near surface higher-grade targets and it is starting to significantly pay off with better-than-expected results.

“We had previously interpreted that the high-grade targets were mostly at depth, but an analysis of the recent results, particularly from MCB-036, which intersected 59 metres at 1.29% copper and 0.27 g/t gold, MCB037, which intersected 28.95 metres at 1.12% copper and 0.06 g/t gold, and now MCB-041, have confirmed the presence of a more extensive shallow copper mineralisation than previously understood.

“We expect these combined results will make a solid positive enhancement to the feasibility study which will commence in early 2023.”

Drilling continues

Drill hole MCB-041 was drilled to test the north-eastern extents of the shallow higher-grade copper mineralisation.

The mineralisation intercepts are interpreted to extend in a sub-horizontal orientation in addition to a series of near-vertical mineralised structures and breccias.

MCB-041 intersected some historical workings, likely to be exploration tunnels from the 1970s, which have extended into the MCB deposit area from the east and prevented drilling to the full depth.

Makilala is continuing to test the extents of the shallow copper mineralisation, with assay results pending for drill hole MCB-042, and the recent commencement of drill hole MCB-043

Flagship project

Location of the MCB Project in the province of Kalinga, Northern Luzon, Philippines.

The MCB Copper-Gold Project is in the Cordillera Administrative Region in the Philippines, about 320 kilometres north of Manila.

It is the flagship project within the Makilala portfolio, which also contains other key prospects in the pipeline for permit renewal/extension.

A maiden JORC-compliant mineral resource for MCB comprises 313.8 million tonnes at 0.48% copper and 0.15 g/t gold, for 1.5 million tonnes of contained copper and 1.47 million ounces of gold.

Positive scoping study

A scoping study for the project in 2021 identified the potential for the development of a copper-gold operation with a 25-year mine life.

The study was based on an underground mining operation and processing facility to produce a saleable copper-gold concentrate.

Highlights from the scoping study included a post-tax NPV (8%) of US$464 million and IRR of 35%, assuming a copper price of US$4.00/pound and gold price of US$1,695/ounce.

Read more on Proactive Investors AU