Accelerating copper demand and a lack of new copper mines coming online present an attractive opportunity for quality ASX-listed copper plays.

The third most commonly mined commodity, copper is widely used in construction and as a crucial component for renewable energy technologies.

Significantly more copper must be produced as economies transition to a low-carbon future. Given its use in electrical motors, wires, cables, wind and solar power facilities, demand for the metal is set to surge in the years ahead.

According to a recent note from Macquarie, by 2027 copper will be in a deficit of 1.3 million tonnes because of the electrification required by the energy transition.

Supply shortage

On the supply side of the equation, the recent shutdown of the Cobre Panamá copper mine in Panama and interruptions to Peruvian and Chilean mine supply will support and even elevate copper prices in the near to medium term, according to analysts from WH Ireland Capital Markets.

Chile is a major global copper producer, but production in Chile is becoming increasingly expensive as mines deepen, while social and political unrest in both Chile and Peru has delayed a number of major development projects, negatively impacting forecast copper supply.

The recent shutdown of Cobre Panamá copper mine in Panama and interruptions to Peruvian and Chilean mine supply will support and even elevate copper prices in the near to medium term, according to analysts from WH Ireland Capital Markets.

Disruptions at major mines are forcing smelters to pay historically steep prices to obtain mined ore. In response, Chinese smelters — which produce more than half the world’s refined copper — are easing production to undertake maintenance work and bring forward annual repairs.

In the first two months of 2024, China’s refined copper production pulled back from the record levels posted toward the end of 2023, with output at 2.215 million tons, or nearly 37,000 tons a day, down from 38,000 tons recorded in November.

Chinese smelters have pledged to cut output by 5%-10% in the face of tighter-than-expected concentrate supply and overcapacity after years of relentless expansion.

Prices surging

According to McKinsey & Co, the world will need 36.6 million tonnes of copper for electrification by 2031, but projected mine restarts, new production projects and recycling are expected to only be able to provide 30.1 million tonnes, leaving a 20% shortfall.

The combination of surging demand, particularly to support the energy transition, along with uncertainties around some forecast supply, point to a rise in deficits which can be expected to support future copper prices.

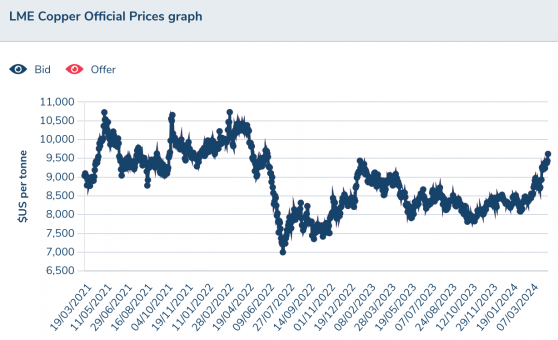

We are already seeing this with copper now priced in excess of US$9,500 per tonne and approaching two year highs.

Copper has traditionally been a leading economic indicator, but there is speculation that demand for copper from the energy transition may see it diverge from other the industrial commodities, aluminium and zinc, that are also seen as economic bellwethers. That would explain further copper price rises in the face of falling global inflation.

In recent decades, these three metals have followed similar price trends, driven by the economy because the market hasn’t been worried about a fundamental shortage of supply. But an acute supply shortage in copper will eventually give the metal a measure of support that other industrial metal indicators, like aluminium and zinc, might not have.

"The economic indicator status of copper is about to change, regardless of the state of the world economy. Copper should find a level of stability that is not dictated as much by current demand, but by the realisation that future demand will dwarf current supplies," said American Pacific Mining (CSE:USGD) MD of exploration Eric Saderholm.

Read more: Here are some other ASX-listed copper plays that made progress during the December quarter of 2023: Mixed signs for copper but demand from renewable energy and EVs strengthening

Potential near-term, low-cost producer

WH Ireland has recognised Celsius Resources Ltd (ASX:CLA, AIM:CLA) as a potential near-term, low-cost copper producer that could help ease supply crunch and support the electrification of global economies.

Celsius is advancing a portfolio of copper-gold projects in the Philippines that, once in production, could help support the continued electrification of global economies to reduce the emission of greenhouse gases.

The company was issued a mining permit on 14 March 2024 — a milestone it had been working towards for a number of years — granting exclusive rights to undertake rational exploration, development, and commercial production of copper and associated minerals at the Maalinao-Caigutan-Biyog (MCB) project for an initial 25-year term.

The MCB deposit comprises classic porphyry style copper-gold mineralisation with a high-grade sub vertical core, representing around 28% of the total Mineral Resource Estimate. Now with a mining permit in hand, Celsius will work with the government and local communities to develop the MCB project in a sustainable manner.

A recent WH Ireland research report on Celsius stated: “We believe Celsius is well-positioned to benefit from interrupted near- and mid-term copper supply, and strong copper prices.”

The company has indicated that its MCB and Sagay copper projects could be brought into production within two years and selling copper concentrates to buoyant markets, subject to licensing and funding.

Revenues from the MCB and Sagay copper projects could provide Celsius with the funding to advance other projects in its portfolio, including the earlier-stage Botilao Prospect, also in the Philippines, and a Namibian asset, the Opuwu Copper-Cobalt Project, which will also be supported by the global transition to electrification.

Diversification of commodities and jurisdiction is provided via the Opuwo project – one of the largest undeveloped cobalt resources outside the Democratic Republic of Congo (DRC).

Compelling portfolio of copper projects

WH Ireland sees fair value for Celsius at 8.8 cents per share (4.6p/share), based on current exchange rates. This represents a significant premium to the current share price of 1.3 cents.

Behind this valuation is the belief that MCB could be in production by the first quarter of 2026, transforming Celsius from project developer to producer.

The MCB mining project feasibility study (MPFS) and Sagay have set out mining cases and established potential routes to production.

As it currently stands, the MCB resource could support mining operations over at least 25 years, which could be increased with further drilling and the recent addition of the adjacent Botilao tenement.

Further near-term production potential lies with Sagay. A mining project feasibility study for the project is based on secondary copper mineralisation developed in shallow, weathered zones adjacent to a much larger porphyry system. There may be potential to recover this mineralisation via shallow-surface mining to produce a copper concentrate via simple processing techniques.

Studies indicate that the initial capital requirement to achieve production at Sagay is less than $15 million.

WH Ireland suggests that any revenues generated could help in funding exploration of the adjacent copper-gold porphyry — a potential second, large-scale project in the Celsius portfolio.

Copper price to support further upside

The analysts’ valuation is based on a long-term copper price of US$8,800 per tonne, compared to the price at the time of its report in January of around US$8,400 per tonne. However, copper has since spiked above this level to its current price of above US$9,500 per tonne. Copper prices above WH Ireland’s long-term price forecast would have a significant impact on our valuation of Celsius.

Longer term, even higher prices are anticipated as the copper market faces a sustained deficit amid an acceleration of the green transition and increased demand for ‘green’ metals, including copper.

If Celsius managing director Peter Hume is right, even at modest estimates a rise to “around US$13,000 to US$15,000 a tonne will not be out of the question”.

WH Ireland summarised its view of Celsius, saying “Celsius has a compelling portfolio of copper projects that offer, subject to funding, the potential to generate near-term revenues that could provide the platform to develop long-lived mining assets.

“With near-term, low-cost revenue potential, paired with growing copper demand and a lack of new near- and mid-term operations coming online, we believe Celsius is well-positioned to benefit from the next copper boom. We see fair value in Celsius at 4.6p/share/A$8.8c/share.”