Catalyst Metals Ltd (ASX:CYL) is on course to complete the definitive feasibility study (DFS) for its Trident Underground Deposit in the Plutonic Gold Belt of Western Australia next year after fielding high-grade gold intercepts of up to 64 g/t from reverse circulation and diamond drilling.

The gold mining and development company completed 40 drill holes in July, infilling various gaps in the Trident mineral resource aimed at supporting the DFS.

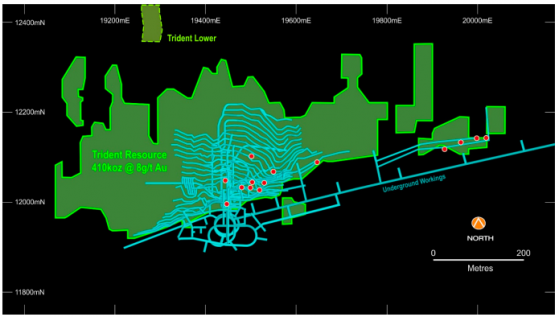

Trident hosts an indicated mineral resource of 945,000 tonnes at 9.4 g/t gold for 285,000 ounces and an inferred resource of 645,000 tonnes at 6 g/t gold for 125,000 ounces.

Initial results from the infill drilling campaign have confirmed the continuity of the asset's high-grade mineralisation and included significant intercepts such as:

- 14 metres at 2.55 g/t gold from 144 metres;

- 8 metres at 10.05 g/t from 190 metres;

- 9 metres at 33.31 g/t from 155 metres;

- 12 metres at 6.1 g/t from 139 metres;

- 12 metres at 12.89 g/t from 149 metres; and

- 9 metres at 64.39 g/t from 180 metres.

Plan view showing Trident mineral resource, preliminary mine design and locations of significant drillhole intervals.

“Comfort drilling”

Catalyst managing director and chief executive officer James Champion de Crespigny said: “This infill drilling program at Trident is an important step for Catalyst to progress the Trident DFS.

“One might describe this drilling as comfort drilling – there were gaps within the Trident resource where Catalyst preferred to have closer spaced drilling.

“This infill drilling closes those gaps, giving greater comfort to the mineral resource and ultimately the DFS.”

Scoping study

The Trident deposit is on existing mining leases about 25 kilometres northeast of the Plutonic gold mine and is connected to the latter’s mill via a well-maintained road.

Catalyst recently released the results of a scoping study at Trident, demonstrating the potential for strong pre-tax cashflows estimated at A$294 million, with low upfront development capital of A$36 million.

The study estimated production at 230,000 ounces of gold over an initial four-and-a-half-year mine life, with an average grade of 6.7 grams per tonne of gold.

Read more on Proactive Investors AU