Catalina Resources Ltd (ASX:CTN) is evaluating the rare earths potential of its Dundas project thanks to the latest round of aircore re-splits.

The multi-element explorer reported fresh assays from re-splits of Dundas’ 4-metre composite samples, with two of the holes returning more than 1% total rare earth oxides (TREO).

Catalina’s latest assays confirm that Dundas is home to a sizeable heavy rare earth oxides (HREO) ratio, weighing in at 19% HREO/TREO, while high-value critical magnet metals like neodymium and praseodymium account for 24% of total rare earth elements.

With mineralisation open in all directions, Catalina believes that Dundas shows promise as an emerging rare earths play in a prospective but underloved region.

The story so far

Back in December 2022, Catalina rolled out a 105-hole, 2,909-metre maiden aircore campaign, designed to test the mettle of Dundas’ rare earth targets.

The project forms part of a greenfields zone in WA’s highly prospective Albany Fraser belt, where Catalina is on the lookout for several precious and critical minerals.

Assays to date indicate Dundas boasts rare earth intersections measuring up to 10 metres thick. Thanks to the latest aircore re-splits, there’s particular interest in two drill holes:

- hole 22DAC095, which intersected 3 metres at 0.92% TREO, including 1 metre 1.78%. Adjacent holes (measuring roughly 100 metres apart) are also very anomalous; and

- hole 22DAC066, which intersected 2 metres at 1.02% TREO and 2 metres at 0.18% TREO in the bedrock at end of hole.

Catalina has also reported very high neodymium readings in both holes — one of the four key ingredients needed to manufacture permanent magnets.

Critical magnet metals are especially important to the automotive and electric vehicle industries, which rely on permanent magnets to keep the motors running.

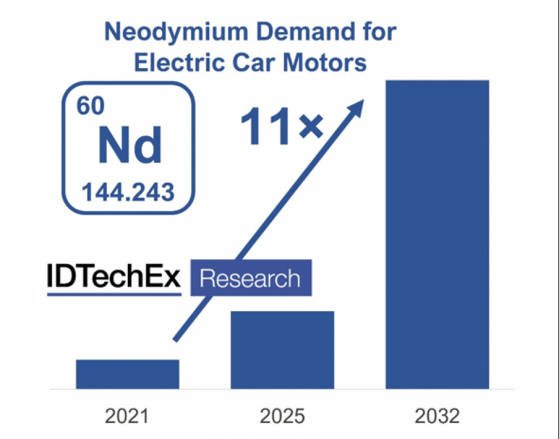

IDTechEx expects neodymium demand for electric car motors to increase 11-fold by 2032. Source: IDTechEx.

However, with nearly all of the world’s high-strength permanent magnets currently made in China (and reports that the superpower is weighing an export ban on some rare earth magnet tech), there’s a growing business case for domestic supply chains.

At present, the Lynas-owned rare earth mine in WA’s Eastern Goldfields is the only rare earths producer in Australia, meaning there’s plenty of room for emerging players to enter the scene.

Where to from here?

With the initial aircore campaign off the to-do list, Catalina can focus on extending and enhancing Dundas’ high-grade rare earth hits.

As part of its broader mission, the explorer will also continue the hunt for other high-value minerals like lithium and gold.

To satisfy both objectives, the team will carry out an ultrafine, multi-element soil geochemistry campaign, designed to prove up future drill targets.

From here, Catalina hopes to get the reverse circulation drill spinning on Dundas’ best anomalies.

Read more on Proactive Investors AU