As global demand-supply dynamics for copper become increasingly more favourable, Castillo Copper Ltd is making all the right moves at both its Big One Deposit at the NWQ Project in Queensland and at the Cangai Copper Mine in New South Wales.

To continue its forward momentum, CCZ has appointed service provider Entech Mining to progress development work at Big One.

The multi-disciplinary specialist mining consultant will undertake a pit optimisation and mine design study for the Big One Deposit which has an inferred resource of 2.1 million tonnes at 1.1% copper for 21,886 tonnes of copper metal.

Depending on results, CCZ will then detail effective processing options and a viable path to market.

As Entech undertakes its work, CCZ will focus on capitalising on Big One Deposit’s exploration potential via drill-testing known targets north of the line of lode.

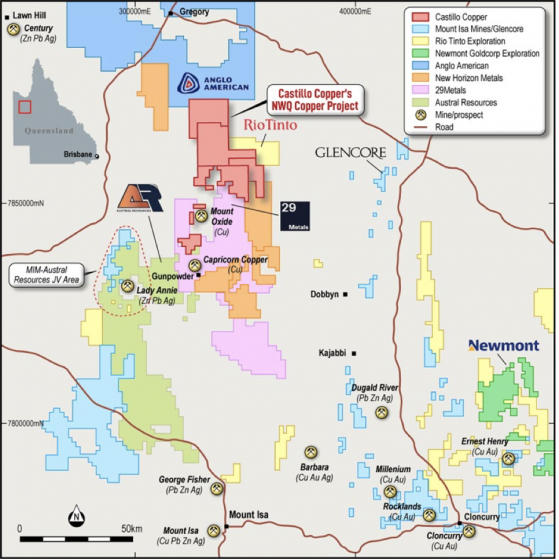

The current work is significant in that CCZ’s footprint in the Mt Isa copper belt is proximal to ground owned by majors including Rio Tinto (ASX:RIO), Anglo America, Teck & Glencore (LON:GLEN).

CCZ's NWQ copper project relative to peers.

In recent years, interest in the Mt Isa copper belt has grown significantly and CCZ is well positioned in the region.

CCZ has a large footprint in the Mt Isa copper-belt district in northwest Queensland, which delivers significant exploration upside through having several high-grade targets and a sizeable untested anomaly within its boundaries in a copper-rich region.

“The board is well versed in the current global demand-supply dynamics for copper which by all accounts suggests explorers, like Castillo Copper with inferred resources, are potentially prime beneficiaries,” Castillo Copper’s chairman Ged Hall

“Having recently outlined plans to ramp up advancing the Big One Deposit and Cangai Copper Mine, the board is delighted to announce the appointment of this key service provider to progress development work.”

Geology team to enhance MRE at Cangai

In early March, CCZ said it was moving to optimise the Cangai Copper Mine in northern NSW and plans to upgrade confidence in the mineral resource estimate (MRE) and model by leveraging extensive drilling work completed since the original estimate in 2017.

Read: Castillo Copper optimisation plans for Cangai Copper Mine to include resource upgrade

The CCZ geology team has been tasked with updating and enhancing the confidence in the 2017 inferred JORC MRE of 107,589 tonnes of copper metal.

Drilling work post-2017, which includes 34 RC drill holes for circa 5,000 metres, will be included into the geological model.

On top of this, Cangai Copper Mine still delivers exploration potential as DHEM surveys in 2018-19 identified several untested bedrock conductors that are open at depth.

Read more on Proactive Investors AU