Carnavale Resources Ltd (ASX:CAV) has delivered a robust maiden mineral resource estimate (MRE) and a promising scoping study for Swiftsure deposit at the Kookynie Gold Project, 60 kilometres south of Leonora, Western Australia.

Maiden resource

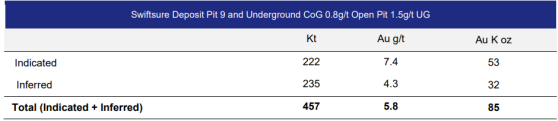

The initial MRE for the Swiftsure deposit stands at 457,000 tonnes at 5.8 g/t for 85,000 ounces of gold, including a high-grade ‘ounce dirt’ zone containing around 53,000 ounces at 31.2 g/t gold. Notably, 61% of the Swiftsure resource is classified in the indicated category.

This resource remains open at depth and along strike, offering significant potential for expansion. Additionally, new discoveries at the Tiptoe and Valiant targets present promising opportunities to increase the resource base at Kookynie.

Robust economics

The scoping study explored several open pit and underground mining scenarios, identifying a compact open pit and underground development as the most profitable approach.

This study highlighted robust financial metrics and a competitive cost profile, using conservative mining parameters and current cost assumptions.

Some of the key financial outcomes of the study, based on a gold price of A$3,500 per ounce, include:

- a pre-tax Net Present Value (NPV) in the region of A$91 million with an internal rate of return (IRR) of 192%;

- an undiscounted cash flow of around A$105 million;

- total pre-production capital of about A$3 million, with a maximum drawdown of A$12.9 million in the eighth month of operations;

- an initial mine life of 32 months with a capital payback period of 14 months;

- an initial mine production target, including dilution, of around 421,000 tonnes at 4.6 g/t for 62,000 ounces of gold;

- 93% of mineral resources extracted during the payback period classified as indicated from the open pit;

- a total all-in cost of about A$1,730 per ounce recovered; and

- 56% of production derived from the open pit.

Strategic location

The Kookynie Project benefits from its proximity to several operating gold processing plants in the Eastern Goldfields.

Carnavale has evaluated the economics based on a contract operator and toll treatment operation, ensuring simplicity and efficiency.

The scoping study was conducted by independent consultants Cube Consulting Pty Ltd.

"Valuable niche project"

CEO Humphrey Hale said: “We are delighted to announce the results of the maiden resource and scoping study for the Swiftsure deposit at Kookynie highlighting a very valuable niche project.

“Swiftsure represents a new discovery in the historic Kookynie mining camp, close to Leonora, and has similar high-grade characteristics of the historic mines 2 kilometres to the east such as Cosmopolitan, Diamantia and Altona.

“Swiftsure is characterised by bonanza grade plunging shoots within a vein structure that has extensive strike extents. The high-grade shoots within Swiftsure contain the fabled ‘ounce dirt’ or 53,000 ounces at 31.2 g/t, which ensures robust financials for the project.

“Carnavale appointed independent consultants Cube Consulting to calculate the maiden MRE and run a number of mining scenarios to establish the best way to develop the Swiftsure project.

“The study demonstrates robust economics and provides various pathways to value for Carnavale shareholders.

“This is just the starting position for the Kookynie Gold Project, as the high-grade shoots that contain ‘ounce dirt’ remain open at depth and there are multiple additional targets along strike that have the potential to host additional high-grade shoots in fresh rock, at depth.

“We are excited about the exploration upside to the Kookynie Gold Project.”

Read more on Proactive Investors AU