Carnarvon Energy Ltd (ASX:CVN) CEO Philip Huizenga presented the company’s progress over the past year to the recent annual RIU Essential Energy Conference, showcasing what he called Australia’s premier liquids-rich, low-carbon portfolio.

Highlights in the company’s recent journey included a renewed focus on the Dorado Project in the Bedout Sub-basin, a new-look board, and cost reductions aimed at enhancing shareholder value.

Dorado’s considerable potential

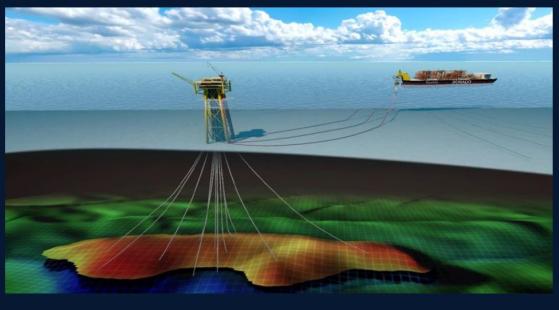

Dorado is part of a larger Bedout Sub-basin energy development and offers considerable potential, with 491 million barrels of oil equivalent (mmboe) of gross contingent resources already discovered.

Future exploration plans target a further 5.2 billion barrels of prospective resources.

A shallow-water development at only around 100 metres underwater, Dorado is one of the nation’s largest undeveloped conventional energy resource projects.

The company is progressing toward a final investment decision with Phase 1, a light-sweet crude and condensate recovery.

During Phase 1 the liquids are produced, and the gas is recycled, maximising ultimate liquids recovery and preserving the gas resource in the sub-surface for Phase 2 gas export.

A major milestone for Carnarvon was the optimisation of the Dorado Phase 1 liquids development project, which includes the right-sizing of the floating production storage and offloading (FPSO) unit and the wellhead platform, along with a phased approach to drilling.

Lower Capex

These changes are expected to lower capital expenditure and improve project efficiency as the company targets a final investment decision (FID) in 2025.

Huizenga illustrated the company’s robust financial position, supported by A$180 million in cash and an additional A$138 million in development carry.

Carnarvon remains debt-free, with a strong balance sheet poised to support ongoing exploration and development efforts.

The company is keen to drive home the exploration potential of its portfolio, particularly in the Bedout Sub-basin, which has been identified as one of Australia’s most prospective regions for hydrocarbons, and several oil and gas prospects that it is eyeing for further development.

These include the Pavo, Roc, and Phoenix South fields, which offer substantial upside potential.

Gas on the table too

Carnarvon is also advancing its gas exploration campaign, aiming to unlock further value in a market with increasing demand for energy security.

The company’s strategic collaboration with its joint venture partners also plays a critical role in its long-term growth plan.

As part of the Dorado development, Carnarvon and its partners are assessing FPSO vessel redeployment options, which could reduce costs and expedite time to first production.

In addition, the company’s commitment to a phased approach in developing its projects ensures capital efficiency and maximises returns.

The integration of future gas export potential from the Dorado field further solidifies Carnarvon’s position as a key player in Australasia’s energy market, with the ability to contribute to regional energy security while maintaining a focus on low carbon emissions.

Carnarvon is working with J.P. Morgan to explore alternative transactions that could accelerate value for shareholders, potentially including mergers or asset sales.

The company is focused on delivering value through the Dorado development while maintaining a lean, efficient corporate structure.

This strategy positions Carnarvon well for growth, with the Dorado Phase 1 development on track and promising exploration opportunities across its extensive Bedout portfolio.

Read more on Proactive Investors AU