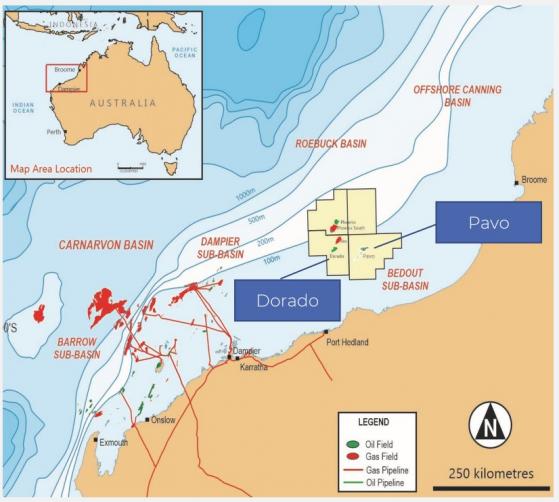

Carnarvon Energy Ltd (ASX:CVN) is cashed up to advance its Dorado discovery within the Bedout sub-basin on Western Australia’s North West Shelf with more funding on the way following the divestment of a 10% interest in its Bedout assets to CPC Corporation, Taiwan, for US$146 million.

The company is also aiming to integrate the Pavo oil field, a discovery made in 2022, into the proposed Dorado production facilities, with this work now well advanced.

Carnarvon reported a strong cash balance at the end of the June quarter of A$95 million and no debt.

Closing the divestment to CPC is expected to increase Carnarvon’s cash reserves to around A$178 million and bring an additional US$90 million (~A$129 million) carry towards funding the company’s share of the Dorado development costs.

Following the completion of the CPC divestment, Carnarvon will be in a strong position with around A$310 million in liquidity (cash and development cost carry).

The Dorado oil field was the largest oil discovery made on Western Australia’s North West Shelf in three decades when it was discovered in 2018.

Uncovered as part of the greater Phoenix exploration campaign in the Bedout sub-basin, Dorado is an important development in Australia’s energy landscape, estimated to hold about 162 million barrels of light oil and condensate, on a gross 2C basis.

Combined with the estimated gross 748 billion cubic feet of 2C contingent gas resource, Dorado has been assessed to hold a gross 2C contingent resource of 344 million barrels of oil equivalent.

A successful appraisal program in 2019 de-risked the Dorado development, which is currently in the front-end engineering and design (FEED) phase.

The current field development envisages the oil and condensate from Dorado being produced through a well-head platform and tied back to a floating production storage and offloading (FPSO) vessel capable of processing 75,000 to 100,000 barrels per day.

Carnarvon holds a 20% interest in the Dorado discovery, with operator Santos Ltd (ASX:STO) holding the remaining 80% equity.

Pavo oil discovery

The Pavo North oil discovery was made in 2022, with the Pavo-1 well intersecting significant reservoirs and confirming net oil pay across a zone of 46 metres.

The discovery at Pavo North has been assessed to hold 43 million barrels of oil (gross, 2C), with the discovered resource lying just 46 kilometres to the east of the planned Dorado oil field development.

Both the Pavo and Dorado discoveries contain an extra light, sweet product, meaning the proposed Dorado FPSO vessel could handle production from Pavo North via a simple tie-back development.

Quarterly activities

During the June quarter, the key area of focus on the Dorado development pertained to maturing the scope of work for integrating Pavo into the proposed Dorado production facilities, with this work now well advanced.

Another area of focus during the quarter was the planning for environmental approvals required for post-FID (final investment decision) activities.

New procedures for these approvals were established following court action by a Tiwi Islands group in respect of Santos’ Barossa project.

In short, these now require more extensive stakeholder engagement procedures which will be factored into the Dorado development process.

Overview of Carnarvon’s partial divestment of Bedout Basin.

Carnarvon continues to progress the divestment of 10% equity in its Bedout Subbasin assets to OPIC Australia, a wholly owned subsidiary of CPC Corporation, Taiwan.

At this time, the majority of conditions required to close the transaction have been satisfied, with CPC working diligently to satisfy the final condition, being the approval of the Foreign Investment Review Board (FIRB).

While this process can take several months, the parties are targeting satisfaction of this final condition and completion of the partial divestment in the September quarter.

In the meantime, Carnarvon has been working with its partner, Santos, in preparation for CPC joining the joint venture.

Read more on Proactive Investors AU