The lure of gold is undeniable. Its allure is partly due to its scarcity but mostly, it is because the quintessential precious metal has a reputation as a safe haven that holds its value over time.

Throughout history, we have mined around 208,874 tonnes of gold, according to the World Gold Council. If every single ounce of this gold were stacked together, it would only be about the size of an 8-storey building.

With concerns about inflation and a potential global recession, investors from the world’s central banks to China’s 'damas' (wealthy middle-aged Chinese women) have relied on gold to protect their wealth, in turn, powering demand.

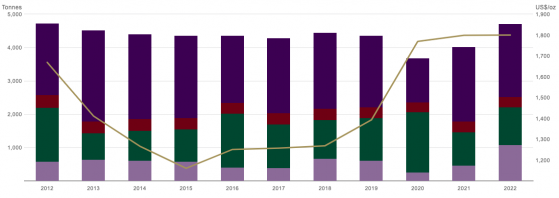

Global gold demand over a 10-year period. Source: World Gold Council.

Another metal meeting a different kind of demand is copper.

Copper has played a vital role in modern society. From smartphones to nearly every piece of electrical equipment and infrastructure ever built, the red metal has been essential for the electrification of just about everything.

With the shift towards a more sustainable future, copper is primed to be one of the greatest beneficiaries.

One company with its finger in both pies is Titan Minerals Ltd (ASX:TTM).

Titan's projects in Ecuador.

In this article:

Emerging South American gold producer

Not just about gold

Ready to drill

Electrifying copper demand

Emerging South American gold producer

The Perth-based mineral exploration company has large-scale projects in Ecuador's southern Andean copper-gold belt and is betting they will provide a major impact on the bottom line and create shareholder value.

The company’s flagship Dynasty Gold Project is an advanced exploration project covering a massive area of 139 square kilometres in the Loja Province.

Situated in a major flexure of the Andean Terrane, the project sits in a region known for its gold deposits stretching from Peru through northern Ecuador.

The 9-kilometre near-surface gold district boasts a Canadian NI 43-101 mineral resource estimate (MRE) of 2.1 million ounces of gold and 16.8 million ounces of silver.

Titan currently has multiple workstreams in place to enhance the understanding of Dynasty and move it towards a JORC 2012-compliant MRE.

Among these, drill testing of extensional targets is underway at the project’s Kaliman Porphyry and Brecha-Comanche targets, with promising results including 3.05 metres at 16.48 g/t gold and 61.66 g/t silver from 142.15 metres at Brecha-Comanche and 102.7 metres at 1.48 g/t gold, 4.50 g/t silver and 0.09% copper from 46.5 metres at Kaliman.

Dynasty’s potential as a gold producer is exceptional as only 20% of the project has been explored to date.

The Dynasty Gold Project.

Not just about gold

While Titan’s considerable focus is on its gold asset, the company is more than just an emerging gold producer.

About 20 kilometres away from Dynasty, Titan is preparing two other promising projects - Linderos and Copper Duke - for the clean energy revolution that is taking place worldwide.

Largely underexplored, the Linderos Project has several prospects with high potential for copper and gold.

Consisting of four contiguous concessions spanning 143 square kilometres near the Peruvian border, exploration has primarily focused on the Copper Ridge and Meseta prospects.

Titan’s maiden drill program of 14 holes in Meseta returned high-grade gold mineralisation near the surface, including 7.22 metres grading 13.77 g/t gold, 12.90 g/t silver, 0.15% copper and 0.38% zinc from 66.28 metres; and 4.88 metres grading 12.87 g/t gold, 6.04 g/t silver, 0.11% copper and 0.41% zinc from 41.0 metres.

Less than 500 metres away, maiden drilling of eight diamond holes at the Copper Ridge Prospect intersected wide intervals of mineralised copper-molybdenum-gold-silver from shallow depths.

Assays worth mentioning include:

- 308 metres at 0.4% copper equivalent (Cu Eq) from 54 metres, including a higher-grade intercept of 76 metres at 0.5% Cu Eq from 132 metres (mineralised to end of hole); and

- 558 metres at 0.2% Cu Eq from surface, including a higher-grade intercept of 72 metres at 0.4% Cu Eq from 21 metres (mineralised to end of hole).

Linderos Project displaying total magnetic intensity RTP, soil sampling (molybdenum) and targets.

“We feel that we’re onto something big here, with our maiden drilling campaigns at both Meseta and Copper Ridge delivering promising results and plenty of scope for extending mineralisation with strong vectors towards higher grade gold, silver and copper mineralisation,” Titan’s chief executive officer Melanie Leighton said in February.

“We now have a pipeline of high conviction targets to feature in forthcoming exploration work programs in 2023.”

Ready to drill

Over at Copper Duke Project, 13 concessions spanning 130 square kilometres are mostly untested by drilling, with only four shallow holes ever drilled.

An airborne geophysical survey identified multiple clusters of intrusive centres, which surface geochemistry confirmed to host gold, copper and molybdenum over a 7-kilometre area.

Importantly, the geophysical signature of the project is similar to many major porphyry districts in the world, including Cerro Casale in Chile and Reko Diq in Pakistan.

Titan is ready to go to the ground to test these targets at any time.

The Copper Duke total magnetic intensity analytic signal, prospects and significant results.

Electrifying copper demand

With countries such as the United States and those within the European Union striving for net-zero emissions by 2050, copper's role in the low-carbon future will lead to a supply shortage by the end of the decade.

The demand for copper is expected to double by 2035, S&P Global said in its report The Future of Copper, adding that the initial increase over the coming decade will be “particularly challenging”.

“Global refined copper demand is projected to almost double from just over 25 million tonnes in 2021 to nearly 49 million tonnes in 2035, with energy transition technologies accounting for about half of the growth in demand.

“The world has never produced anywhere close to this much copper in such a short time frame.

“The conclusion: achieving the stated climate ambitions will require a rapid and massive ramp-up of copper supply far greater than is visible in any private or public plan,” S&P said.

In its report, Goldman Sachs (NYSE:NYSE:GS) said inflation had pushed the incentive price for the world’s top 50 copper projects to invest in copper exploration and production to US$9,000 per ton.

The investment bank predicts that the price of copper needs to reach US$13,000 per ton to encourage mining companies to invest in the US$150 billion required to meet the net-zero targets.

Titan is not just digging for gold, but also setting its sights on a greener future powered by copper.

With their promising projects and the growing demand for these precious metals, the company is ready to strike gold and copper while making a positive impact on the world.

- Written by Julie Goh.

Read more on Proactive Investors AU