The cannabis industry has seen a significant surge in popularity in the last 10 years, leading to enhanced transparency, market understanding and growing revenues.

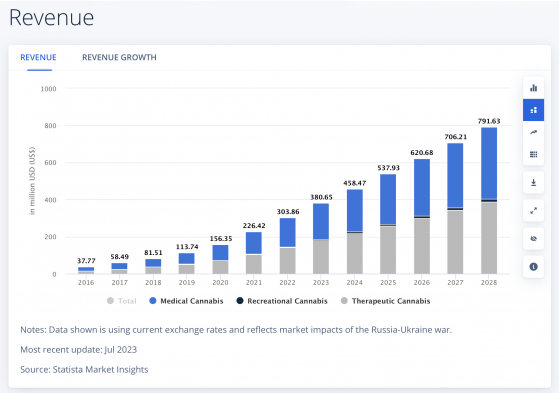

In 2023, the cannabis market is forecast to generate revenues of US$380.60 million. The sector is anticipated to experience an annual growth rate (Compound Annual Growth Rate, CAGR, 2023-2028) of 15.77%, leading to a projected market volume of US$791.60 million by 2028.

When compared globally, the United States is expected to be the largest contributor, with revenues reaching US$33,880 million in 2023. Furthermore, when considering the total population, the revenue per person is expected to be US$59.19 in 2023.

This growth trajectory is mirrored in the industry's impact on the American economy.

The North American market stands out as the largest legalised cannabis market globally, accounting for nearly all cannabis sales worldwide. This is further underscored by the fact that in 2021, North America's largest cannabis multi-state operators (MSOs) raised a considerable $2.8 billion, as reported by Flowhub.

Retail sales in the US cannabis sector are also on an upward trend. The MJBiz Factbook suggests that sales are expected to surpass $52 billion by 2026.

Potential health benefits fuel Aussie market

In Australia, according to Statista the legal cannabis market was valued at US$67.4 million. It is anticipated to reach US$828.2 million by 2033, growing at a CAGR of 30.1% over the next decade. The estimated value for 2023 is $US87.7 million.

Fuelling growth in Australia is the understanding that cannabis may have several medical and health benefits.

The country’s medicinal application sector is set to grow at the quickest rate over the next 10 years. While the government has been slow to move, support for medical purposes is growing. Authorised regulations now allow for convenient access to medicinal cannabis products.

These products are designed to treat everything from anxiety and chronic pain to sleep issues and inflammation.

There is strong demand for beverages, topicals, infused products and even hemp-based chocolates. And with that demand, we are seeing more international and domestic players hit our shores.

From cultivators to suppliers and product innovators, the Australian market is the cannabis world’s gummy bear with food and beverage being the key consumers of the legal market.

Cannvalate, MedReleaf Australia and AusCann are currently the three biggest players in Australia.

The following are Australian small cap players in the cannabis market, doing a wide variety of work.

Four small cap cannabis companies to keep an eye on

Emyria

Emyria Ltd (ASX:EMD) is an integrated clinical drug development and care delivery company focused on mental health, neuropsychiatry and certain neurological conditions.

The company is positioned to lead a global opportunity in the field of mental health and neuropsychiatry empowered by the recent rescheduling of MDMA and psilocybin in Australia.

Emyria’s business model integrates drug development with frontline clinical services. The company is focused on innovative psychological trauma care, with an aim to reimagine the treatment of PTSD, a condition that affects approximately 6% of adults every year.

Its mission is not just to treat, but to develop innovative care models that enhance outcomes for patients and create value for investors.

With an initial supply of MDMA, an ethics-approved care model and active MDMA-assisted therapy (MDMA-AT) underway, Emyria plans to scale its impact through strategic partnerships and the launch of new, research-focused clinical services such as ketamine and psilocybin-assisted therapies.

Of its recent quarter performance, Emyria’s managing director Dr Michael Winlo said, “This quarter, we've made great progress with an integrated business model that is well suited to Australia's leading regulatory environment. Our clinics are delivering solid revenues while raising the bar in mental healthcare by offering best-in-class care and innovative treatments like MDMA-assisted therapy.

“Meanwhile, we've attracted world-class talent to support our mission and advanced various drug development projects. Our approach allows us to make an immediate difference for patients and create value, while positioning us for long-term growth and opportunity in a growing area of need.”

Emyria generated $1,034,172 of clinical billings for the September quarter (an increase of more than 250% compared to the previous quarter) supported by the completed acquisition of The Pax Centre

It also strengthened its cash position: Emyria received firm commitments for $2 million in a placement and a further $1.15 million in a rights issue.

Incannex Healthcare

Incannex Healthcare Ltd (ASX:IHL, NASDAQ:IXHL) is undertaking a multitude of US Food and Drug Administration (FDA) research and development (R&D) programs for cannabinoid pharmaceutical products and psychedelic medicine therapies administered by health professionals.

It has been busy during the September quarter. Here’s a snapshot.

During the quarter, Incannex received approval from the US Food and Drug Administration (FDA) to proceed with its Investigational New Drug (IND) opening pivotal IHL-42X Phase 2/3 clinical trial in the United States.

The trial, planned for patients with obstructive sleep apnoea who are non-compliant, intolerant or new to positive airway pressure treatment, will assess the effects of IHL-42X, dronabinol, acetazolamide, and a placebo.

Participants will undergo daily sleep quality surveys, monthly clinic visits to evaluate sleep outcomes and safety, and regular polysomnography to assess the impact of treatments on Apnoea Hypopnea Index (AHI) and other sleep parameters.

Combining Phase 2 and Phase 3 in a single Phase 2/3 trial allows for a more efficient transition from the early stages of testing (Phase 2) to the final stages required for regulatory approval (Phase 3), potentially accelerating the availability of this new treatment to patients subject to continued clinical success.

Also during the quarter, Incannex commenced preparations for an investigational new drug (IND) application to the US Food and Drug Administration (FDA) for its psilocybin-assisted psychotherapy development program known as Psi-GAD. The IND application is a crucial regulatory step required for conducting clinical trials in the United States

Incannex announced its intention to redomicile to the United States via a Scheme of Arrangement pursuant to Australian law. A newly formed Delaware corporation (Incannex Healthcare Inc.) will become the ultimate parent company of the group.

At September 30, 2023, Incannex recorded A$25.3 million in cash at bank.

MGC Pharmaceuticals

MGC Pharmaceuticals Ltd (LSE:MXC, OTC:MGCLF, ASX:MXC), a European-based pharmaceutical company specialising in the production and development of plant-derived medicines released its positive Quarterly Activity Report for the three months ending September 30, 2023.

The highlights include:

- MGC received an order for US$1 million from AMC Pharma (AMC) to produce ArtemiCTM (the Over the Counter (OTC) version of CimetrA®). This order comes alongside AMC's new supply agreement to distribute to over 100 Holistic and Wellness Chiropractic offices in California and Florida.

- Positive results from Pre-clinical Chronic Toxicology Evaluation of 14 days oral dose of CimetrA®.

- New regulation in Australia was passed making it the first country to allow psychiatrists to prescribe psilocybin psychedelics to treat depression or post-traumatic stress disorder (PTSD).

- MGC was granted its first permit to import 200g of Psilocybin Raw Mushroom material to its Slovenian research facility.

- The company conditionally raised A$1.24 million by way of a placing and subscription.

- MGC successfully completed a share purchase plan raising A$834,000.

“We are pleased to report on a productive September quarter for the business. MGC has received an order for US$1 millionm from AMC Pharma to produce ArtemiCTM," MGC Pharma managing director and CEO Roby Zomer said

"This order comes alongside AMC's new supply agreement to distribute to over 100 Holistic and Wellness Chiropractic offices in California, and Florida. The company has also been granted its first import permit to its Slovenian research facility.”

At the end of the September quarter, the company had around A$417,000 of cash on hand. It recently secured the single largest injection of funding in the company's history.

It also released its plans for H124.

Hygrovest

Hygrovest Ltd (ASX:HGV, OTC:MMJJF) is an Australian-listed, specialist investment company that has traded on the ASX since 2015.

Investors in Hygrovest gain exposure to a globally diversified portfolio that seeks to produce capital growth over the medium term from investments in listed and unlisted equities and debt securities.

On August 23, 2023, Hygrovest announced that it had executed an Investment Management Agreement appointing HD Capital Partners Pty Ltd to act as investment manager of HGV’s investment portfolio. The appointment is for a term of five years commencing July 1, 2023.

HD is a value-oriented, fundamental bottom-up stock picker focusing on opportunities in listed small cap equities markets including:

- undervalued, well-managed growth companies, often founder-led, that are off the radar of the broader investment community;

- undervalued securities where HD seeks to realise value; and

- situations that are dependent on a specific corporate action, such as mergers, liquidations, tender offers and divestments.

Read more on Proactive Investors AU