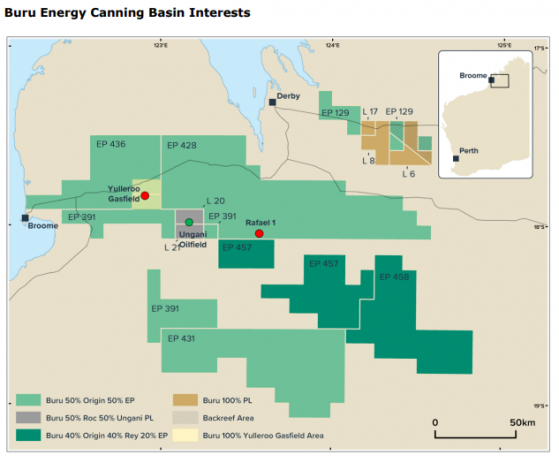

Buru Energy Ltd (ASX:BRU) has responded to news that Origin Energy intends to exit upstream exploration permits and divest 50% of its joint venture interests with Buru in the Canning Basin.

The company says that Origin’s intentions to withdraw stem from its funding and strategic imperatives and are not a reflection on the quality and potential of the Canning Basin assets shared with Buru, including the Rafael gas and condensate discovery.

In late June Origin advised Buru that it would require additional time to consider the required internal Origin approvals for the testing and 3D seismic operations at the Rafael 1 gas condensate discovery.

Extensive discussions

The two companies have since been in extensive discussions about the forward program for the Canning Basin, which include a proposal by Buru for a sole risk operation, though this was contested by Origin.

Discussions have not resolved the issue. In the event that a third party becomes involved, it will be required to demonstrate financial and technical competence and to assume Origin’s remaining funding obligations under the existing farm-in agreements and under the various permit joint venture agreements.

In addition to this there are a number of milestones under the various agreements that must be complied with by either Origin or an incoming party.

Given Origin’s stated intentions, Buru will continue the consultation process on these matters and will co-operate to ensure Origin’s orderly exit from the Canning Basin.

Buru’s expectation is that this process will take some time to complete and it is now expected that this will result in the delay of any field operations until the 2023 Northern Australian operating season.

The company will continue to keep the market apprised of this situation.

Management structure

In the meantime, Thomas Nador has assumed his previously announced position as CEO and executive chairman Eric Streitberg is stepping through a structured handover of his executive responsibilities to Nador.

Streitberg will be taking leave in October and his transition to a fully non-executive chairman role will be completed by the end of the year.

Executive chairman Streitberg said: “While it is very disappointing that Origin’s actions have caused a significant delay in Canning Basin field operations, Origin’s now expressed intentions provide the clarity required for us to move the project forward.

“The Canning Basin has enormous potential and we are pleased that this potential attracted a partner of Origin’s stature, with the subsequent Rafael discovery by the Buru/Origin joint venture being transformational for the basin and for Buru.

“Origin had been a supportive partner up until this change in strategy and we now look forward to the resolution of the structure of the joint venture to enable us to quickly advance the project.

"While Origin’s process is underway, we will continue to prepare for both future field operations and the commercialisation program for the Rafael discovery.

“In relation to the management structure of the company, the commencement of Thomas as CEO comes at an opportune and appropriate time for what is a very exciting period for the company with the possible introduction of a new and aligned joint venture partner in the Canning Basin and real progress being made in Buru’s energy transition subsidiaries.”

Read more on Proactive Investors AU