Botala Energy Ltd (ASX:BTE) welcomes an independent wellfield feasibility study outlining development options for the Serowe Coal Bed Methane (CBM) Gas Project in Botswana, with modelling of development options, risks and costs confirming the commercial potential of using gas to generate electricity and especially to produce LNG.

The comprehensive independent feasibility study, completed by Fraser McGill of South Africa, considered the commercial development of the wells drilled to date at Project Pitse — Botala's first commercial pilot project within the Serowe project.

The study addressed the development of wells and gas extraction, and was complemented by a pre-feasibility concept study for midstream and downstream options.

The company said: "Completion of these comprehensive technical and financial studies mark a significant milestone for Botala and its Serowe CBM Gas Project.

"The positive outcomes provide a strong foundation for advancing the project to the development stage by demonstrating commercial gas production, followed by rapid production increases."

Positive commercial outcomes

The study outlined positive commercial outcomes featuring attractive internal rates of return (IRRs) and net present values (NPVs) for the lowest gas flow and very positive figures when medium and high flows were considered.

Botala says that the feasibility study for the total project becomes bankable when offtake agreements are secured and downstream development options are adequately developed.

The company is now in advanced negotiations with potential offtakers and expects to sign offtake agreements shortly. This will be supported by both the huge local industrial demand for gas and the forecast gas shortage in South Africa from early 2027 onwards.

Low-cost commercial production of LNG by 2026

“This feasibility study provides the confidence to commence developments for Botala to become a modest, low-cost commercial producer of LNG by 2026, with the ability to then rapidly increase production at a time when South Africa is expected to face a severe gas shortage,” said Botala CEO Kris Martinick.

“This expansion is expected to be funded mainly by a combination of debt and cash flow from wells coming into production progressively,” he added.

Development options considered

The wellfield feasibility study included a review of the wellfield design, based on low, medium and high gas flow rates adequate for a 10MW of gas power generation supported by a recent CBM Resource Certification.

It also provided a pathway for development of the gas and highlighted the commercial viability and strategic importance of gas.

Commercial opportunities considered

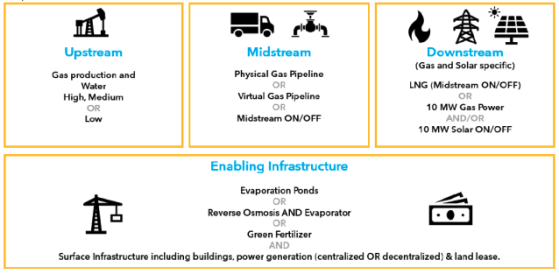

The concept study assessed both upstream, along with midstream and downstream options.

The section of the feasibility study covering upstream options was completed to a bankable standard with a higher level of engineering and cost definition for low, medium and high flow-cases.

The pre-feasibility concept study considered mid-stream and down-stream options, which will be further defined once a design flow rate is established based on the outcomes of the five well pilot well cluster of Serowe-3.1, or “Project Pitse”.

Downstream options considered to maximise commercial potential include gas compression (CNG), liquefaction (LNG), and power generation with connection to the Southern African Power Pool. Botala expects to decide downstream options soon.

The company also notes that the conclusions of the study are subject to achieving sustained gas flows of greater than ~40 thousand standard cubic feet per day (mscf/d) and securing necessary funding and sales agreements.

Gas from the Serowe-3.1 well was flared on three occasions to demonstrate gas flow in the absence of stimulation. On each occasion the unsustained gas flow exceeded the low-gas case flow of 40mscf/d shown in the feasibility study as commercially viable. Following flaring, gas flow was turned off for environmental, safety and operational reasons and the other four wells of the five-well pilot cluster were drilled.

Read more on Proactive Investors AU