Boadicea Resources Ltd (ASX:BOA) ended the June quarter with $2 million in cash and no debt leaving the company well-funded to achieve its planned activities, including four tenement drilling campaigns in 2024 focused on lithium and nickel discoveries.

In its quarterly, company management said, “During the period, BOA has sold its $306,551 shareholding in Trigg Minerals Ltd. The sale reflects BOA’s strategic decision to divest its holdings in TMG and provides BOA with additional capital to advance its core exploration projects.

“The shareholding in TMG was part of the consideration paid by TMG when buying a 90% interest in four Queensland tenements from BOA in Q1. BOA is free carried by TMG for its remaining 10% interest in the four tenements.

“The 2024 budgeted expenditure allocates 76% of BOA’s capital for direct in-ground activities.

"The company continues to maintain a tight control on administration and personnel costs to ensure efficient use of its capital.

"Management recognises the challenging environment for junior explorers and will be fine-tuning the planned drill programs to ensure they are optimally located to deliver results as efficiently as possible.

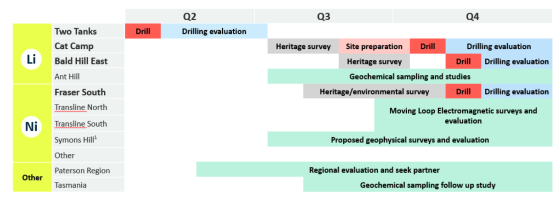

"The planned Heritage Surveys have suffered delays and as a result, the planned drilling for Q3 will be conducted later in the year.

“BOA will focus on completing the evaluation of its Fraser Range holdings as well as the Koongulla tenements in the Paterson Province. These tenements are highly prospective for gold mineralisation and BOA will be seeking a partner for the drilling of these tenements.”

Meanwhile, the company has plenty of work ahead:

Four-tenement drilling program

BOA is advancing a four-tenement drilling program, pending final approvals, focusing on lithium and nickel exploration in Western Australia.

The tenements include Cat Camp, Bald Hill East, and Fraser South.

BOA tenements to be drilled in 2024 in southern Western Australia.

The Bald Hill East tenement, about 2 kilometres from the Bald Hill lithium mine, will target a potential extension to the mineralised zone.

The Cat Camp tenement in the Lake Johnston/Lake Percy region, will concentrate on areas with known pegmatites and nickel mineralisation, targeting shallow and thick local pegmatites with anomalous lithium identified through surface geochemistry.

In the Fraser Range, BOA plans to drill the Snowys Prospect, a highly conductive anomaly identified from an electromagnetic survey over the Fraser South tenement.

The Fraser Range's mafic-ultramafic intrusions host significant nickel, zinc, copper and cobalt mineralisation. The Snowys Prospect could potentially contain Nova- or Andromeda-style modified Volcanogenic Massive Sulphide (VMS) mineralisation.

Location of the Snowys Prospect in the Fraser South tenement, Fraser Range.

Heritage surveys are ongoing, and BOA is awaiting approval of its Conservation Management Plan before it starts drilling at Snowys.

Two Tanks drilling reveals lithium

While it prepares for drilling at the aforementioned tenements, BOA has announced the completion of its drilling program at Two Tanks in the Mt Ida region of Western Australia, an emerging lithium province.

This program involved 18 aircore drill holes totalling 1,296 metres. Geochemical analysis of pre-analysis samples indicated fractionated pegmatitic units with potential for lithium mineralisation at depth.

The recent multi-element assays confirmed a consistent degree of fractionation, shown by K/Rb ratios mostly below 40, aligning with characteristics of fractionated pegmatitic units. The drilling campaign also investigated the Copperfield Granite contact.

Several holes were drilled to intersect and drill past this contact, successfully defining and characterising it to prospect level accuracy. This characterisation will support future drill hole planning. Establishing depth trends in pegmatite fractionation and potential lithium grades will be a key focus of future exploration at Two Tanks.

Summary map of the April 2024 drilling campaign at Two Tanks, showing highlights of assayed pegmatite intervals. The red highlighted area will be the next focus of exploration.

Fraser Range feelers

IGO Ltd operates three exploration tenements in the Fraser Range under an agreement with BOA. These tenements are Symons Hill (E28/1932), Transline North (E28/2849) and Transline South (E28/2866).

Drilling activities over the Ballast NE and Eggpie prospects in Transline North (E28/2849) and Transline South (E28/2866) have identified these areas as highly prospective for nickel, copper and cobalt mineralisation.

BOA nickel-focused exploration tenements in the Fraser Range region of southern Western Australia.

IGO will proceed with ground electromagnetic surveys to locate potential nickel-copper-cobalt sulphide accumulations, focusing on the large Ballast magnetic 'eye' feature at Ballast NE and the Eggpie prospect.

The discovery methods used, including soil geochemical surveys, aircore drilling, MLEM surveys and RC drill testing, are similar to those that led to the discovery of the Nova nickel-copper deposit.

Mafic and ultramafic magmas, essential for forming massive nickel-copper sulphide deposits, are present along the Fraser Range belt.

IGO's in-house Mafic Prospectivity Index (MPI) rates the mafic rocks at Eggpie and Ballast NE highly, indicating significant potential for nickel and copper similar to the Nova mafic intrusion.

Read more on Proactive Investors AU