Boadicea Resources Ltd (ASX:BOA) has won two out of three ballots to snap up a lithium-nickel licence near its Bald Hill East Project in WA.

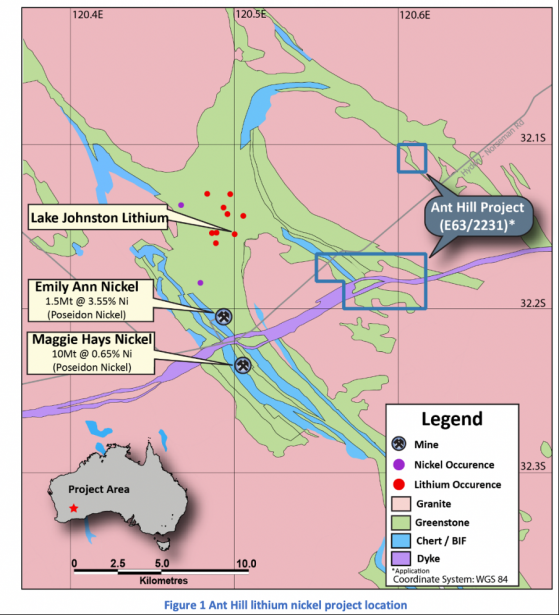

The licence, colloquially known as Ant Hill, is at the heart of a highly prospective lithium region 450 kilometres east of Perth.

Explorers are focused on a 50-kilometre corridor that spans the southern and western margin of the Lake Johnston granite batholith, where lithium prospects are known to occur.

With two projects under application, Boadicea is now sitting on three Aussie lithium opportunities, boosting its critical minerals tenure to 402 square kilometres.

Nickel prospectivity

Furthermore, the company's nickel prospectivity has also grown with Ant Hill being just 7 kilometres from the Maggie Hays and Emily Ann nickel deposits.

Boadicea has kicked off the approvals process and will update the market when it formalises the Ant Hill acquisition.

Complements corporate strategy

Boadicea managing director Jon Reynolds said: “The ballot win in a highly competitive process with four other applicants provides a significant exploration exposure to a well-known but under-explored lithium region of Western Australia.

“The addition of the Ant Hill lithium-nickel projects complements our corporate strategy to increase our exposure to low-entry cost, but highly sought-after EV mineral projects.

“We look forward to updating all shareholders as the Ant Hill licence is granted and exploration activities get underway.”

Renowned region

Lake Johnston has attracted substantial exploration interest thanks to its proximity to the Earl Grey Lithium Project at Mt Holland (roughly 77 kilometres west of the Ant Hill licence).

Mt Holland is one of Australia's largest undeveloped hard-rock lithium projects, with ore reserves estimated at 94.2 million tonnes at 1.5% lithium oxide.

Teamed with Poseidon Nickel’s Lake Johnston project around 7 kilometres east, Ant Hill is shaping up as a lithium-nickel opportunity.

Thanks to the acquisition, Boadicea’s lithium exposure now includes the Bald Hill East and Ant Hill projects in WA and the Hanns Gully lithium-tin-tantalum project in Queensland.

BOA said the portfolio was a vital part of its broader corporate strategy: to align exploration with the electric vehicle commodity revolution.

Read more on Proactive Investors AU