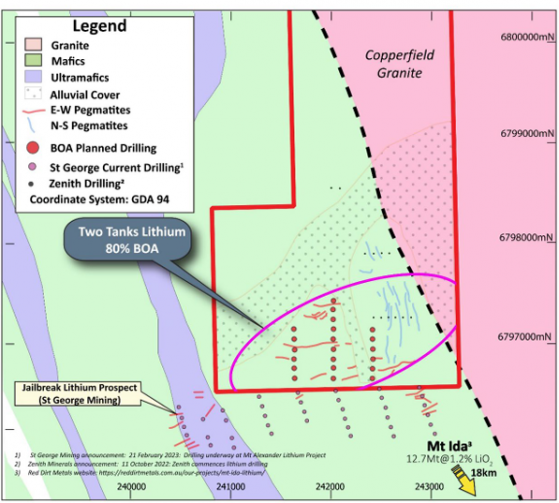

Boadicea Resources Ltd (ASX:BOA) has enhanced its critical metals portfolio after completing terms for the acquisition of 80% of the Two Tanks Lithium Project in the highly prospective Mt Ida pegmatite corridor of Western Australia.

The area around Two Tanks is emerging as a new lithium province with significant developments along a prospective zone with a strike zone of around 35 kilometres and a number of drill-ready targets.

Boadicea has submitted a program of works (PoW) for an initial 21-hole reverse circulation (RC) drill program to test the lithium prospectivity of the east-west orientated pegmatites.

Moving forward, the company will kick off prerequisites for the program, including heritage surveys, to allow drilling to begin next quarter.

Advanced drill-ready prospect

Boadicea managing director Jon Reynolds said: “The Two Tanks project provides the most advanced, drill-ready lithium prospect in the Boadicea portfolio.

“Due to its potential, we have prioritised Two Tanks exploration and have already progressed planning for drilling.

“Our commitment to exploration is reinforced with the acquisition of Two Tanks and our commitment to continue to channel more than 80% of our expenditure into in-ground exploration efforts.”

About Two Tanks

The Two Tanks Project is in the highly prospective Mt Ida pegmatite corridor, which includes Red Dirt’s Mt Ida Project and St George Mining’s Mt Alexander Project.

Numerous lithium-bearing pegmatites were identified within the tenement indicative of lithium, caesium and tantalum (LCT) fertile pegmatites.

Presently, the exploration is targeting east-west striking pegmatite dykes interpreted to be the same system as the adjacent St George Mining Jailbreak lithium prospect which is being drilled.

Two Tanks lithium exploration potential

Acquisition terms

Boadicea has acquired 80% equity of E29/994 from Mark Selga for A$150,000 in cash and $150,000 in newly issued Boadicea shares.

The shares will be priced at $0.08 per share, with new shares to be allotted to Selga or his nominee under the company’s 15% placement capacity within 14 days.

Lithium strategy

Boadicea is developing a portfolio of lithium exploration tenements that have high-quality exposure to some of Western Australia’s most prospective pegmatite-hosted lithium regions including the Bald Hills region, Lake Johnston region and Mt Ida region.

Read more on Proactive Investors AU