BlackEarth Minerals NL (ASX:BEM) is looking to the future at its Maniry Graphite Project in Madagascar thanks to a positive definitive feasibility study (DFS).

The study envisions a financially and technically robust graphite hub that meets the criteria to transform raw materials into lithium battery components.

Interestingly, the DFS also confirms Madagascar is an optimal location for graphite processing and has the potential to be the largest producer of graphite outside China.

With the DFS under its belt, BlackEarth is pressing ahead with a detailed environmental and social impact study, designed to further enhance Maniry’s viability.

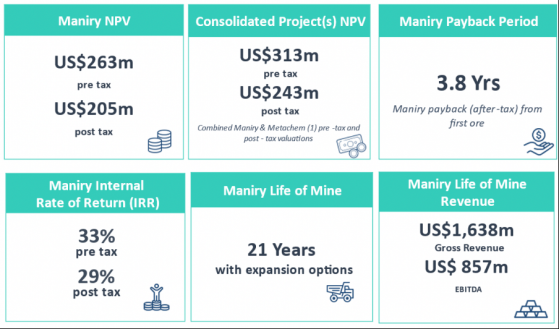

The key DFS metrics are outlined below:

"All the ingredients" for world-class project

Speaking to the findings, BlackEarth managing director Tom Revy said: “The DFS confirms that Maniry is on track to be a world-class graphite project that will generate strong financial returns, underpinned by an exceptional resource and robust processing route.

“The study supports our view that Maniry will be perfectly placed to capitalise on the enormous opportunity to supply graphite for use in lithium batteries.

“The graphite supply shortfall is widely forecast to grow rapidly from next year onwards, increasing prices and profit margins for producers in the process.

“Demand for non-Chinese graphite is expected to be even stronger as battery manufacturers and electric vehicle makers look to diversify their sources of supply.

Revy went on to say that Maniry’s location gives it a strategic edge.

“The government there is highly supportive and the country’s production and export of graphite is projected to expand rapidly over the next few years,” he explained.

“This DFS provides more firm evidence that we have all the ingredients required to take full advantage of what is rapidly shaping up to be a boom time for graphite producers”.

Crunch the numbers

BlackEarth founded its DFS on work conducted by CPC Engineering, which completed the flow sheet design, advised on a range of mining and infrastructure requirements and assessed the capital requirements for Maniry’s stage one and two operations.

The graphite stock has charted the course over a 21-year project

Stage one of the graphite hub is expected to cost just shy of US$80 million to get up and running, while stage two will set the company back US$24.6 million in capital costs.

Over the project’s life of mine, BEM will have to expend around US$650 to produce one tonne of graphite material.

Maniry’s maiden operation is poised to generate around 39,000 tonnes of graphite concentrate every year, while stage two will add a further 56,4000 tonnes per annum.

With a 32.65% internal rate of return, a US$204.8 million net present value after tax and a 3.8-year payback period, BlackEarth believes it’s considering a financially robust operation that can support future graphite demand.

The price is right

BlackEarth has adopted a weighted basket price of US$1,448 a tonne (using a free on board shipping model) for the life of its operation.

This pricing is based on short-term market projections and, conservatively, does not provide for any price increases that may occur as and when the global supply of natural graphite falls (as predicted) well below projected demands.

Lithium-ion batteries now account for almost 50% of graphite demand and BlackEarth believes this will increase as electric vehicles and clean energy solutions come to the fore.

In fact, consultancy Benchmark Mineral Intelligence estimate that graphite production will need to double by 2025 to meet surging demand from EV automakers.

As a result, BlackEarth sees Madagascar as uniquely positioned to lead the global supply of ethically produced graphite to meet rising demand.

Read more on Proactive Investors AU