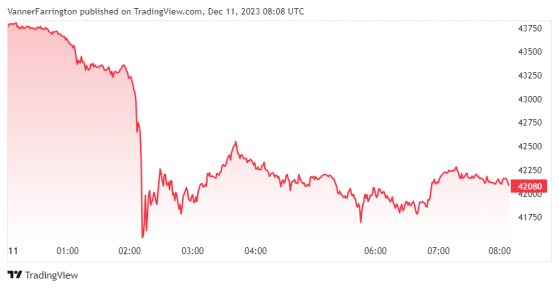

Bitcoin (BTC) made one of the more bizarre candlesticks seen in a long time in Monday’s opening hours, with the low-price wick extending way down to $40,400 from an intraday high of $43,800.

This 7% fall in BTC/USDT’s spot price occurred in the space of a few hours, before buyers stepped in to bring the pair back above $42,080 at the time of writing.

It marked the most volatile morning in months for the world’s largest cryptocurrency, though no motivating factor was apparent.

Up to $90 million in long-bitcoin positions were wiped from the futures markets as a result of the unexpected volatility.

Bitcoin’s dramatic start to the week followed a comparatively quiet weekend, with spot prices falling one percentage point on Saturday and adding 0.2% on Sunday.

There could be more volatility ahead of Tuesday’s US inflation read.

The market expects inflation to fall to 3.1% in the November print, but an upside surprise could weigh on bitcoin and other risk-on assets.

Bitcoin plummeted 7% in opening Asia trading hours – Source: tradingview.com

Despite the nosedive, bitcoin is still more than 150% higher year to date.

Ethereum (ETH) plummeted over 8% to $2,262 in this morning’s ruckus, but has since corrected back to $2,235.

The ETH/USDT pair remained fairly stable over the weekend, closing 0.8% lower on Saturday before adding half a percentage point yesterday.

Prices dropped across the board in the wider altcoin space this morning, with Binace’s BNB token, Ripple (ZRP), Cardano (ADA), Solana (SOL) and Dogecoin (DOGE) paring mid single digits from their respective market capitalisations.

Only Avalanche (AVAX) remanded higher, having added 6.5% overnight.

Global cryptocurrency market currently stands at $1.5 trillion, with bitcoin dominance at 53.7%.

Read more on Proactive Investors AU