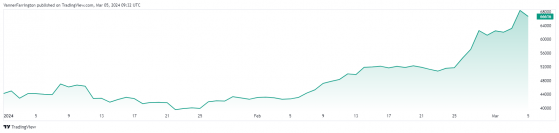

Bitcoin (BTC) came within US$300 of its all-time high on Monday when the BTC/USD pair touched US$68,700.

It has been a marvellous year for the world’s largest cryptocurrency, thanks in part to the sweeping approval of spot-bitcoin exchange-traded funds in the US.

Tuesday trades were less lively, with bitcoin falling 2.6% to US$66,600 as of 9.35am, UK time.

Year to date, bitcoin is up more than 57% against the US dollar.

Gold, meanwhile, has reached a new record high of US$2,118, with April futures pointing to further gains as traders eye up interest rate cuts.

Bitcoin’s rally comes as the demand for ETF products tracking the cryptocurrency continue to prove popular.

Matteo Greco, research analyst at Fineqia International Inc (CSE:FNQ, OTC:FNQQF), stated: “The BTC Spot ETFs continue to exhibit strong momentum, with a cumulative net inflow of approximately $1.7 billion recorded last week, bringing the total net inflow since inception to about $7.4 billion.

“Leading the race is the Blackrock (NYSE:BLK) Bitcoin ETF (IBIT), which surpassed $10 billion in assets under management (AUM) last week, setting a record as the fastest ETF in history to achieve this AUM milestone.”

Frank Holmes, chief investment officer of U.S. Global Investors (NASDAQ:GROW), surmised that major US-based investment managers are increasing their bitcoin portfolio weighting recommendations to high-net-worth clients.

Bitcoin continues to pump in first quarter of 2024 – Source: tradingview.com

Week on week, bitcoin is up 18% against the US dollar, with the second-largest cryptocurrency Ethereum (ETH) adding 14%.

Meme coin Shiba Inu (SHIB), meanwhile, has gone parabolic with a 280% week-on-week pump.

Dogecoin (DOGE) is up over 990%, with Solana (SOL), Cardano (ADA) and Ripple (XRP) posted week-on-week gains in the upper teens.

Global cryptocurrency market capitalisation currently stands at US$2.5 trillion, with bitcoin dominance at 54%.

Read more on Proactive Investors AU