Bitcoin (BTC) continues veering towards its all-time high, with another 2.6% added against the US dollar this morning.

The BTC/USD pair is currently swapping just below $65,000, meaning there is just $4000 of water between now and the previous ATH of $69,000 achieved in November 2021.

The benchmark cryptocurrency has catapulted higher this year predominantly due to the introduction of spot-bitcoin exchange-traded funds to the regulated US stock market.

New bitcoin ETFs from the likes of BlackRock (NYSE:BLK) and Fidelity have seen substantial cash inflows, creating a groundswell of demand for the cryptocurrency.

Last Bloomberg data has total net ETF inflows since their January 10 approval at $7.35 billion.

Excluding the substantial outflows from the Grayscale Bitcoin Trust (GBT), inflows total more than $16 billion.

BlackRock’s iShares Bitcoin ETF (IBIT) continues to lead the charge, having exceeded $10 billion in assets under management at the tail end of last week.

According to Bloomberg’s James Seyffart, the bitcoin ETF market saw net outflows on Friday “almost certainly” due to the Gemini/Genesis situation.

The Winklevoss Twins’ Gemini crypto exchange has agreed to repay US1.1 billion in crypto lost from the collapse of its Earn staking platform.

Gemini may be redeeming their bitcoin to fund the repayments.

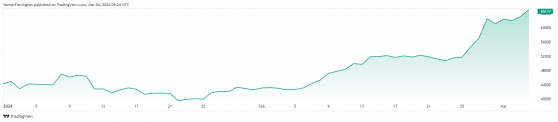

Nonetheless, bitcoin remains in a strong position, having added 35% week on week and 54% year to date.

Bitcoin’s year-to-date performance – Source: tradingview.com

Ethereum (ETH), the second-largest cryptocurrency, is currently trading 13% higher week on week at US$3,523.

In the broader altcoin space, Solana (SOL) has added 28% week on week with Cardo (ADA) surging 36%.

But it’s the two premier meme coins, Dogecoin (DOGE) and Shiba Inu (SHIB) that have seen the most impressive gains.

DOGE has nearly doubled in value while SHIB has soared over 180%.

Meme coins are known to be the biggest risers when interest in altcoins begins to pick up, though their volatility can cause wild swings lower as well as higher.

Global cryptocurrency market capitalisation currently stands at $2.43 trillion, with bitcoin dominance at 54.2%.

Read more on Proactive Investors AU