Benchmark cryptocurrency bitcoin (BTC) has somewhat stabilised since plummeting consistently throughout June.

Although it dipped 1.4% against the dollar today, this follows a bullish weekend where the BTC/USD pair rallied over 3% before holding onto these gains on Monday.

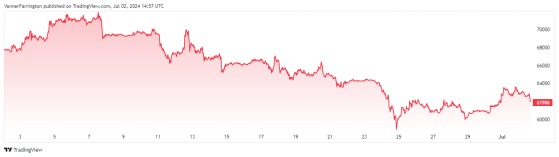

However, bitcoin remains nearly 9% down month on month, with price performance hampered by mixed trends in the spot bitcoin exchange-traded fund scene.

Bitcoin’s poor month-on-month performance – Source: tradingview.com

“BTC spot ETFs saw neutral flows last week, with a $37 million outflow,” noted Matteo Greco, research analyst at Fineqia International Inc (CSE:FNQ, OTC:FNQQF).

“The net outflow occurred entirely on Monday, amounting to about $175 million, followed by four days of slightly positive flows, breaking a streak of seven consecutive trading days with net outflows.

Total ETF inflow since inception is now $14.5 billion, with cumulative trading volume surpassing $300 billion, reaching approximately $311.8 billion.

Trading trends are exposing the “significant influence” of bitcoin ETFs, reckons Greco.

“From January to June 2024, weekend trading volume accounted for only 16% of the total, the lowest ever recorded for this period (H1 of a year).

“This indicates increased activity from traditional finance investors, with trading volume concentrated during Monday to Friday and particularly strong during US market hours, decreasing after the US market closes.”

Read more on Proactive Investors AU