Bitcoin is struggling to pick itself off the floor after falling to a five-month low last week.

The world’s largest cryptocurrency flopped below $54,000 on Friday and while Saturday saw some recovery, the market went bearish again on Sunday.

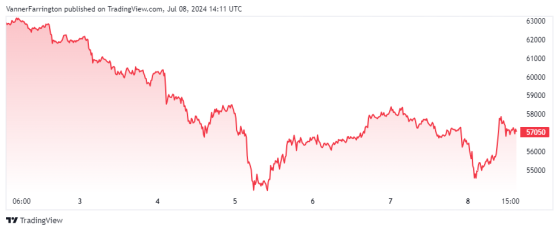

The BTC/USD pair managed to claw back 2.3% worth of losses today, but at $57,050, it remains nearly 9% lower week on week.

Bitcoin's bearish week-on-week performance – Source: tradingview.com

This is despite spot-bitcoin exchange-traded funds experiencing positive inflows last week, with about $238 million in net inflow,” according to data shared by Matteo Greco, Fineqia International Inc (CSE:FNQ, OTC:FNQQF)’s research analyst.

Cumulative trading volumes since spot-bitcoin ETFs went live in January are now around $315 billion, according to Fineqia’s data.

While there has been an evident decrease in trading activity since the novelty has worn off, Greco said it “aligns with expectations and typical market behaviour, as Q3 usually has the lowest trading activity”.

The data suggest that bitcoin’s recent price dip shows no correlation to ETF inflows.

This indicates that “recent price behaviour has been driven mainly by trading activity within the crypto-native space”.

So what has caused this negative trading activity?

As previously flagged here at Proactive, the bitcoin market is at risk of substantial selling pressure owing to the commencement of Mt Gox repayments.

The bankruptcy estate of Mt Gox, which was a prominent bitcoin exchange before going bust a decade ago, owns as much as $8 billion worth of bitcoin.

Reactionary traders may be betting on a headwind from these redemptions, leading to exits in the short term.

On top of that, bitcoin miners remain in sell-off mode following the April bitcoin Halving.

“Although this selling pressure appears to be decreasing in recent days, it still exceeds demand, contributing to the negative short-term price action,” said Greco.

Read more on Proactive Investors AU