Bitcoin swung lower against the US dollar in the latter half of Tuesday's trading session.

The benchmark cryptocurrency had climbed as high as $71,500 throughout the day, benefiting from strong gains in the previous two days, before facing sell pressure from the market.

Today, the BTC/USD pair shows little signs of life, adding around 0.1% to trade on the $70,000 line.

Things appear to be picking up on the exchange-traded fund front, having enjoyed $418 million in net cash inflows yesterday, according to Farside’s ETF tracker.

Prior to Monday, the ETF market saw five straight days of net outflows, sparking concerns that the market’s outstanding debut in January was a flash in the pan.

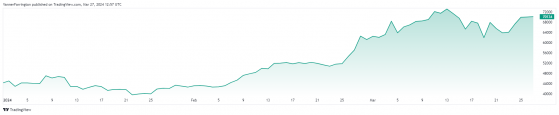

Year to date, these ETFs have enjoyed around $11.7 billion in net cash inflows, a solid performance that has contributed to bitcoin’s 65% rally.

Bitcoin’s YTD performance – Source: tradingview.com

Bitcoin is up 9.6% week on week, with the second-largest cryptocurrency Ethereum (ETH) added 6.8%.

In the wider altcoin space, Dogecoin (DOGE) has pulled ahead, rallying nearly 40% week on week, while BNB, Solana (SOL) and Ripple (XRP) are up in the mid single digits.

Global cryptocurrency market capitalisation currently stands at $2.64 trillion, with bitcoin dominance at 52.2%.

Read more on Proactive Investors AU