Bitcoin (BTC) is in the middle of its fourth straight day of losses after closing another 1.8% lower on Wednesday.

The world’s largest cryptocurrency still remains in the green on a week-on-week basis though, thanks largely to a strong run last week.

Exchange-traded fund inflows, which have galvanised the market in 2024, have been a mixed bag. Despite early-week cash inflows, they have tapered off in the past couple of days.

Farside data shows cumulative year-to-date inflows of around $11.8 billion after spending most of April above £12 billion.

According to data shared by CCData via CoinDesk, monthly cryptocurrency trading volumes dipped for the first time in seven months in April.

“This decline followed unexpected macroeconomic data, an escalation in the geopolitical crisis in the Middle East, and negative net flows from U.S. spot bitcoin ETFs, leading to major crypto assets retracing the gains they made in March,” noted CCData.

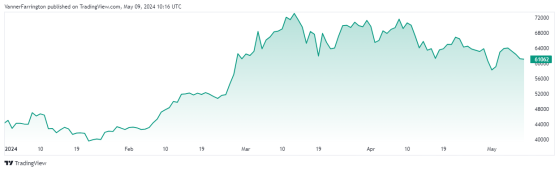

At the time of writing, the BTC/USD pair was swapping for $61,062.

Bitcoin remains 44.5% higher year to date – Source: tradingview.com

As for Ethereum (ETH), the second-largest cryptocurrency is currently swapping for $2,967, or around 1% higher week on week.

In the broader altcoin space, BNB and Solana (SOL) are up in the mid single digits while Ripple (XRP) has dipped into the red.

Global cryptocurrency market capitalisation currently stands at $2.26 trillion, with bitcoin dominance at 53.2%.

Read more on Proactive Investors AU