Bitcoin was trading lower in early Friday exchanges, capping off a volatile week for the world’s largest cryptocurrency.

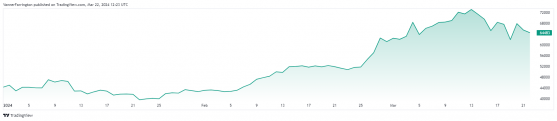

The markets saw a bout of profit taking following last Thursday’s all-time high, dragging the BTC/USD pair 5% lower week on week.

At the time of writing, the pair was changing hands for around $64,500.

Bitcoin remains over 50% higher year to date – Source: tradingview.com

It could have been a worse result if not for Wednesday’s 9.5% rally on the back of record highs in the equities markets.

Risk sentiment surged after the US Federal Reserve reiterated the prospect of three rate cuts occurring in 2024.

But headwinds in the form of exchange-traded fund outflows have offset the Fed rally.

Farside Investors’ bitcoin ETF tracker shows more than $800 million in cash outflows over the past four days, though year-to-date net inflows still remain above $11 billion.

“This challenges the notion that the spot bitcoin ETF flow picture is going to be characterised as a sustained one-way net inflow,” said JPMorgan (NYSE:JPM) analysts of these recent outflows.

They added: “As we approach the halving event this profit-taking is more likely to continue, particularly against a positioning backdrop that still looks overbought despite the past week’s correction,” the report said.

Ethereum (ETH), the second-largest cryptocurrency, has fallen over 7% week on week, while Cardano (ADA), BNB, Dogecoin (DOGE) and Ripply (XRP) are also down.

Global cryptocurrency market capitalisation currently stands at $2.46 trillion, with bitcoin dominance at 53.2%.

Read more on Proactive Investors AU