As the bullet brushed past former President Donald Trump’s skull, taking the hairs off his right ear in an assassination attempt that sadly took the life of an innocent bystander, cryptocurrency traders immediately spurred into action.

Not ones to pass up an opportunity no matter how grisly, spot prices on the world’s largest cryptocurrency rallied higher in the aftermath of the shocking incident at a rally in the Butler Park Showgrounds in Pennsylvania on Saturday.

While the concept that correlation does not imply causation should be considered, there are valid reasons why Bitcoin spiked following the assassination attempt.

Trump struck a defiant figure as he was whisked off stage by security, with his fist in the air and blood running down his face. It is an image even the most hardened anti-Trumpist must admit is captivating.

So captivating that Trump’s chances of trouncing Joe Biden (or a potential last-minute replacement) in the presidential elections appear to have surged higher.

PredictIt’s odds on Trump winning the race ramped up from 61% to 67%.

Whether that is good or bad for the future of the United States is a matter of opinion. As for the markets, there is a clear sense that a Trump victory would be a boon for cryptocurrency.

Trump has emerged as the pro-crypto candidate of choice, despite previously citing reservations about the decentralised economy.

The Republican National Committee has pledged to “end Democrats’ unlawful and un-American crypto crackdown and oppose the creation of a Central Bank Digital Currency”.

Trump has even been named as a keynote speaker at the upcoming Bitcoin 2024 conference, although there is all but a zero chance of that happening, at least in person, following the attempt on his life.

Regardless of what happens and putting aside questions of correlation and causation, Bitcoin is undoubtedly well bid right now.

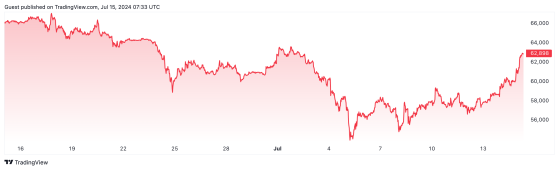

The BTC/USD pair rallied over 5% over the weekend and more than 3% this morning, bringing the pair close to US$63,000 at the time of writing.

That’s 12% higher week on week, though still around 5% lower month on month.

Bitcoin remains in the month-on-month red – Source: tradingview.com

Read more on Proactive Investors AU