Bitcoin (BTC) is trading bearishly once again this Wednesday, dropping more than 3% against the US dollar.

Following a low-single-digit fall on Wednesday, it brings the BTC/USD pair close to falling below $60,000 for the second time in a fortnight.

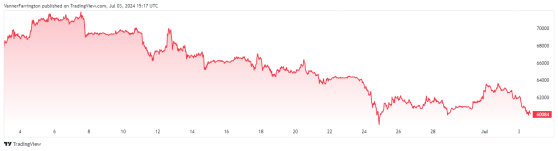

Bitcoin is now more than 11% lower month on month and 2.7% lower week on week.

Bitcoin loses double digits over past 30 days – Source: tradingview.com

Market uncertainty appears to be the name of the game, with the heightened prospect of a second Trump presidency causing traders to scratch their heads as they attempt to navigate choppy political waters.

US Treasury yields are on the rise (thus their prices are falling), with the 10-year bond nearing 4.5% earlier this week as the market mulls the prospect of populist Trumpenomics embodied by increased borrowing and further tariffs.

Grayscale analysts have also warned of a “supply overhang” as various entities, including the Mt Gox Estate and German and US governments commit to selling large volumes of their bitcoin holdings.

“Crypto markets pulled back in June 2024 as pockets of Bitcoin selling pressure triggered a broader reduction in investor risk appetite,” said Grayscale.

“In addition to these new sources of selling pressure, Bitcoin miners continued to reduce their holdings,” the firm added.

According to Glassnode, bitcoin miners sold around 1,560 bitcoin valued at $100 million in June.

Read more on Proactive Investors AU