You miss all the bitcoin predictions you don’t make, so the saying goes.

With that paraphrased parable out of the way, what can we expect for bitcoin in 2024?

Major bitcoin catalysts

Fundamentally speaking, there are two major catalysts to keep an eye on in the first half of 2024.

The first is such a well-trodden issue that this reporter’s hands struggle to even type the words.

Those pesky spot-bitcoin exchange-traded fund applications from the likes of Grayscale, BlackRock (NYSE:BLK), VanEck and Fidelity have the market on tenterhooks.

From as far back as 2015, Grayscale has been attempting to convert its closed-ended Grayscale Bitcoin Trust (GBTC) into an ETF (for the uninitiated, an ETF is a stock exchange-listed product that tracks the price of any underlying asset).

For a long time, the US Securities and Exchange Commission (SEC) has refused to play ball with these applications, until BlackRock joined the fight this year.

BlackRock’s sudden and widely unexpected aping into the bitcoin markets via its own ETF application set the crypto world on fire at the back end of 2023, and nothing has even been approved yet!

The theory goes that should the likes of BlackRock, with its ten trillion dollars of funds under management, start to tap the bitcoin market, bitcoin will head to the moon, Jupiter and the stars beyond.

On the other hand, the rumour could already be priced in, with the news turning out to be a damp squib.

Not to worry, for other catalysts are on the way.

Half-full glass of bitcoin

Mining rewards will halve for the fourth time in April 2024 after the 740,000th block is mined.

Post halving, each block will reward miners with 3.125 BTC compared to 6.25 BTC today.

Supply-and-demand economics stipulate that fewer bitcoins entering the market increases the scarcity of the circulating bitcoins.

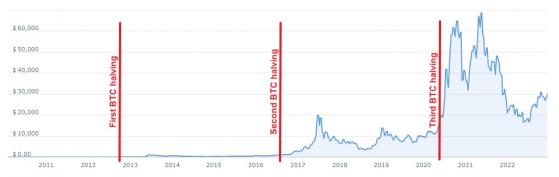

The internet is awash with graphs proving just how great each bitcoin halving has been for the price (like the one below courtesy of Finbold, for instance), though mankind’s propensity for finding rhythm in the madness of markets shouldn’t be ignored.

Has bitcoin reached new all-time highs (ATH) following each halving? Undoubtedly, but as we all know, correlation doth not imply causation, and the periods between each halving and subsequent ATH vary wildly.

Sceptics will also point to the Litecoin (LTC) halving in August this year, which failed to spur any sort of a bull run on the LTC/USDT pair.

If that doesn’t do anything, then there’s also the possibility that the dollar tanks!

Anyway, with the boring stuff out of the way, let’s get down to the good stuff: How much will your bag be worth in 2024?

Bitcoin price predictions

The below analysts have put their necks on the line to give their estimates, but always remember that these are just that: Estimates.

No one really knows where bitcoin will end up in 2024.

Or as Peter Wood, chief technology officer at Web3 recruitment firm Spectrum Search stated: "Predicting Bitcoin's price is a bit like forecasting the weather in London – you know it's going to be unpredictable, but that's half the fun!”

For 2024, Wood sees a “rollercoaster” of a year for Bitcoin: “The crypto space has always been akin to the Wild West, and 2024 won't be any different. My hunch? We could see Bitcoin swing wildly, maybe touching $100,000 at its peak.”

On the flip side, Wood warned that “tighter regulations could keep Bitcoin in a chokehold”, keeping it closer to $50,000.

Malcolm Palle at Coinsilium Group said: “In my view the real bitcoin bull market has yet to kick off, and we need to take out the November 21 peak of $67,500 before that comes into play.”

Could that happen in 2024?

“I think there’s a good chance it will,” said Palle. “And if it does, given the other factors in play such as the highly anticipated SEC approval for the first Spot Bitcoin ETF – which could happen early in the new year – and of course the next four-year halving cycle happening in spring, I think Bitcoin could end 2024 with a six-figure price tag.

“We are certainly hearing calls now for $250,000 Bitcoin in 2025 and many in the digital asset space (myself included) do not see this projection as particularly outlandish, but time will tell.”

Market will ‘reawaken interest’ in bitcoin

Kate Leaman, chief market analyst at AvaTrade, said the halving and ETF hype trains “are set to directly impact bitcoin’s market demand and reawaken interest in its market”.

“As such, the majority of views regarding bitcoin’s price in 2024 are positive… with some even suggesting that its price could reach a new all-time high, possibly exceeding $100,000 or even $200,000 per BTC.

“Meanwhile, other analysts have adopted a more conservative outlook on its price, predicting modest growth of between $50,000 and $80,000 by the end of 2024.”

Freelance blockchain analyst Chasten Hamilton reached out to offer this hot take: "The logarithmic rainbow scale has been used since bitcoin’s creation to show a long-term timeline of adjusted price value.

“If you notice, price increases coordinate usually on a cyclical four-year cycle and right after a halving event.

“With the approval of an ETF from the likes of BlackRock, bitcoin could see anywhere from 15-30 billion dollars injected into the market.

“I personally think this speeds up the timeline to a three-year cycle considering the timing of the circumstances with a halving event next year. This puts Bitcoin in a possible range of 125-150k in a late-2024 price potential."

I can see a bitcoin rainbow – Credit: blockchaincenter.net

“My prediction for Bitcoin's price in 2024 is $50,000,” said Samuel Leach of Samuel & Co Trading. “This forecast is grounded in the expectation that inflation will decline, and the economic pressures affecting consumer spending should start to relax around the second quarter of 2024.

“I believe this scenario could boost demand for bitcoin from a retail perspective. Moreover, we're witnessing a growing interest in cryptocurrency from the banking sector, alongside the submission of new ETFs.

“Should a bitcoin ETF be launched, it is likely to further stimulate consumer demand, potentially driving bitcoin's value above the $50,000 threshold.”

Chief bitcoin historian (yes, that’s a real job title) at CoinGeek, gave us this prediction: “In 2024, I think we will see the beginnings of a bull run, but I don’t think we will hit peaks until late in the year or 2025.

“I also think Layer-1 coin values will be blunted by the fact that ordinal-style token inscriptions have taken a lot of steam away from Ethereum and DeFi. And since these inscriptions are so flexible and well-liked, we might actually see a bull run that leads with some utility this time around - in contrast to prior runs focused almost exclusively on promises.

“Imagine the growth in volume and liquidity all happening in the token layer of a major blockchain instead of all occurring in the USD pairs on major centralised exchanges.”

Let’s be real

Laith Khalaf, head of investment analysis at AJ Bell, signs us off with some careful advice: “Bitcoin bulls will point to (the halving) as a big positive force for the cryptocurrency’s price, and this is likely behind some of the strong performance we’ve seen this year.

“However, this isn’t a shock to supply as such, seeing as halvings occur every four years, and in an efficient market this would already be reflected in prices.

“However, the extreme price volatility in Bitcoin, on occasion prompted by something as extraneous as a tweet from Elon Musk, presents a challenging case study for the hypothesis that markets are rational arbiters of all available information.”

Khalaf wasn’t foolish enough to give a prediction, just a reminder that “you shouldn’t bet your shirt, unless you’re prepared to lose it”.

Read more on Proactive Investors AU