Digital gold Bitcoin (BTC) joined its physical gold brethren in a rally this Monday, though has yet to match the latter in hitting an all-time high (yet).

Bitcoin rose sharply when UK markets opened, adding 2.8% to knock above $71,350 at the time of writing.

If momentum persists, the BTC/USD pair is likely to surpass fortnightly highs, putting it within reach of the $73,777 ATH seen in the middle of March.

A glance at Binance’s order book shows sell orders pitched at $71,500, making this a short-term resistance point for the bulls to surpass.

Bitcoin is benefitting from a resurgence in exchange-traded fund flows following a late-March/early-April decline.

Per Farside’s bitcoin ETF tracker, the bitcoin ETF market saw $203 million in cash inflows last Friday, following $213.4 million the day before.

Year to date, bitcoin ETFs have brought in $12.6 billion net, making for an exceptional price catalyst.

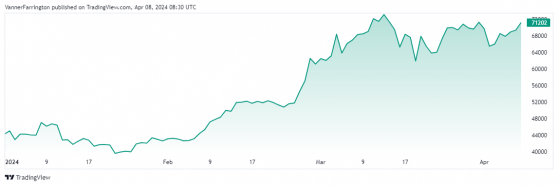

Bitcoin is up 69% in 2024 – Source: tradingview.com

Bitcoin is currently up 2.7% week on week, clearly outpacing the second-largest cryptocurrency Ethereum (ETH), which has risen less than a percentage point.

The ETH/USD pair was swapping for $3,560 at last count.

In the broader altcoin space, BNB and Dogecoin (DOGE) are in the week-on-week green by a few percentage points, while Solana (SOL) has lost 7.3% against the US dollar.

Global cryptocurrency market capitalisation currently stands at $2.66 trillion, with bitcoin dominance at 52.8%.

Read more on Proactive Investors AU