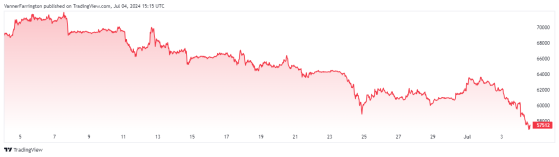

Bitcoin was back in the doldrum this Thursday as the world’s largest cryptocurrency plummeted more than 4% against the US dollar following yesterday’s 3% gutting.

It brings the BTC/USD pair close to $57,500, the lowest point in over two months.

According to Neil Roarty, an analyst at investment platform Stocklytics, the nosedive could be due to substantial selling pressure from various sources, namely the German government and former crypto exchange Mt Gox.

Roarty stated: “The German government holds around $2.5 billion worth of Bitcoin, and has spent the last couple of days moving some of that onto exchanges, with some speculating it is preparing to sell a significant share of its holdings.

“Meanwhile, Mt. Gox is sitting on reserves of around $8 billion in Bitcoin, and is expected to begin returning that to victims of a 2014 hack later this month following a decade-long legal struggle.

“Should an additional 200,000 Bitcoin - valued at more than $10 billion - hit markets in a short space of time, supply will likely outstrip demand, and we could see the price of Bitcoin drop even further.”

Bitcoin goes bearish – Source: tradingview.com

The recent bearishness in the market has caused bitcoin to fall over 16% month on month.

Read more on Proactive Investors AU