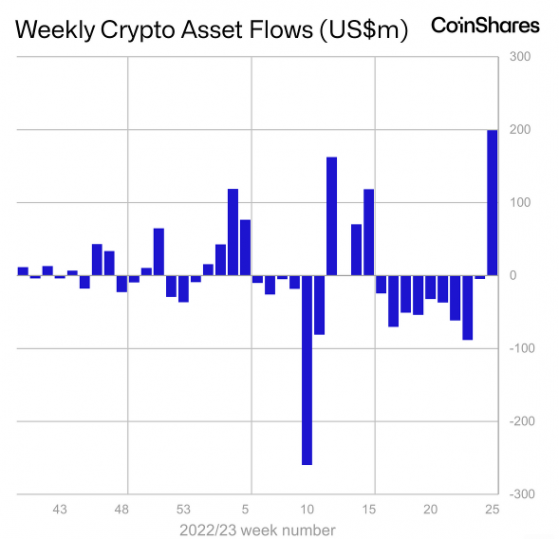

Bitcoin investment products are on a rip right now, with last week seeing the largest rate of inflows since July 2022.

According to data provided by CoinShares, nearly US$188mln (£148mln) was injected into bitcoin funds operated by itself, 21Shares, ProShares and other major fund managers.

Furthermore, short-bitcoin funds that are designed to bet against the price of the world’s largest cryptocurrency saw US$5mln worth of withdrawals, suggesting bullishness is back in vogue.

These inflows corrected nearly half of the outflow witnessed in the past nine weeks, and coincide with a strong rally on the BTC/USDT trading pair.

Source: Bloomberg via CoinShares

Bitcoin’s surge in investor interest comes amid a major institutional push into the bitcoin markets.

BlackRock (NYSE:BLK), the world’s largest asset manager, has officially filed for a spot bitcoin ETF in the US called iShares Bitcoin Trust.

Should the securities regulator give the nod, it would become the first US exchange-traded fund directly linked to bitcoin, whereas only futures contracts are currently permitted.

Furthermore, last week saw the official launch of EDX, a major new cryptocurrency exchange predominantly dealing bitcoin and Ethereum with institutional backing from Charles Schwab (NYSE:NYSE:SCHW), Fidelity, Citadel Securities and other traditional money firms.

Though Ethereum products enjoyed US$7.8mln of inflows last week, month-to-date figures are still bearish at over US$32mln in net outflows, as investors pivot to the safer, more liquid arms of bitcoin.

Other altcoin funds dealing in Litecoin (LTC), Solana (SOL) and Ripple (XRP) was negligible activity.

Total assets under management across all cryptocurrency funds are now at US$37bn, the highest since of onset of the crypto winter in June 2022.

Read more on Proactive Investors AU