The world’s largest cryptocurrency bitcoin is seeing early signs of recovery after trending lower for the better part of a month.

Yesterday saw bitcoin add 1.5% against the US dollar, with another 1.3% reclaimed today.

It marks one of the strongest two-day steaks in the past 30 days, though still puts the BTC/USD pair in negative territory to the tune of 17% month on month.

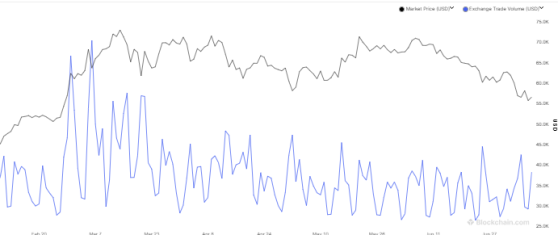

Tepid on-exchange trading volumes since the April Halving event have hampered bitcoin bitcoin’s performance.

The graph below shows a general move lower from the March-April period, when the daily rate of bitcoin distribution was halved, per the four-year halving cycle (the troughs represent weekend trades, when the market largely has its heels up).

Bitcoin trading volumes in 2024 – Source: blockchain.com

Exchange-traded fund volumes have also flip-flopped since the initial hype at the beginning of the year began to cool.

While cumulative ETF trading volume since the January inception has smashed $315 billion, these volumes have undeniably cooled off.

Though as Matteo Greco, research analyst at Fineqia Internation said: “This aligns with expectations and typical market behaviour, as Q3 usually has the lowest trading activity.

“Thus, this data should not be seen negatively but rather as a seasonal trend, especially among traditional finance investors.”

At the time of writing, bitcoin was swapping for $57,357, a decent 7% recovery from a year-to-date low penned last week.

Read more on Proactive Investors AU