Bitcoin (BTC) marched higher over the weekend and continued to gain against the dollar this morning, in a bullish showing for the world’s largest cryptocurrency following its fourth halving event.

The market is bolstered by another outside of the Halving though; risk-on assets have rebounded since tensions between Iran and Israel have momentarily simmered down.

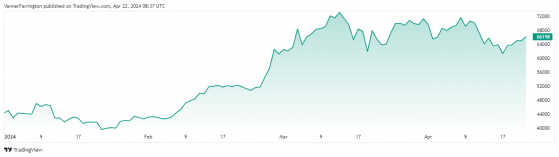

Bitcoin is now up 11% since plummeting to a six-week low of $59,600 on Friday, a day before the Halving.

Transaction fees on the bitcoin blockchain spiked to all-time highs immediately following the Halving. While they have come down significantly, fees on the network are still some of the highest yet seen in 2024.

Grayscale analysts deduced that this could be a benefit to bitcoin miners who have seen their daily mining rewards slashed in half post halving.

“If transaction fees normalise at a level higher than in the past, the impact of the halving on miner revenue will be dampened,” they wrote in a research piece on the matter.

At the time of writing, bitcoin was swapping for $66,198.

Bitcoin is up 57% year to date – Source: tradingview.com

Ethereum (ETH) has benefitted from bitcoin’s stronger price, adding around 3% over the weekend and another 2% today. At the time of writing, the ETH/USD pair was swapping for $3,209.

In the broader altcoin space, Ripple (XRP) is up 3.4% week on week, while BNB is up 4.5% and Cardano (ADA) a flat 3%.

Meme coin Shiba Inu has surged 14.5% over the past seven days.

Global cryptocurrency market capitalisation currently stands at $2.43 trillion, with bitcoin dominance at 53.6%.

Read more on Proactive Investors AU